- Bitcoin's fast, reliable, and global transaction infrastructure enables derivatives exchanges to expand globally at a rapid pace, as customers in every corner of the world are eligible and able to send collateral and start trading in mere minutes.

- Bitcoin collateralized exchanges are the clearinghouse. The exchange itself acts as the clearinghouse and seize collateral when the counterparty defaults. The exchanges themselves decide the optimal maintenance margin threshold and automate the liquidation process while also building insurance funds to cope with extreme market movements.

- By using bitcoin (or other crypto assets), the exchanges can offer trading products with far higher leverage than those of the regulated markets. While the higher tiers of leverage are extreme, and expected returns are more analogous with those of casinos, data from BitMEX clearly show that users are not shy to commit to trades with the highest tiers of leverage available.

- Traders who don't want to have stablecoin exposure or sit with dollars have an option to put their bitcoin at work in leveraged trades.

- The inverse nature of the bitcoin collateralized derivatives is ideal for shorting.

The Futures market

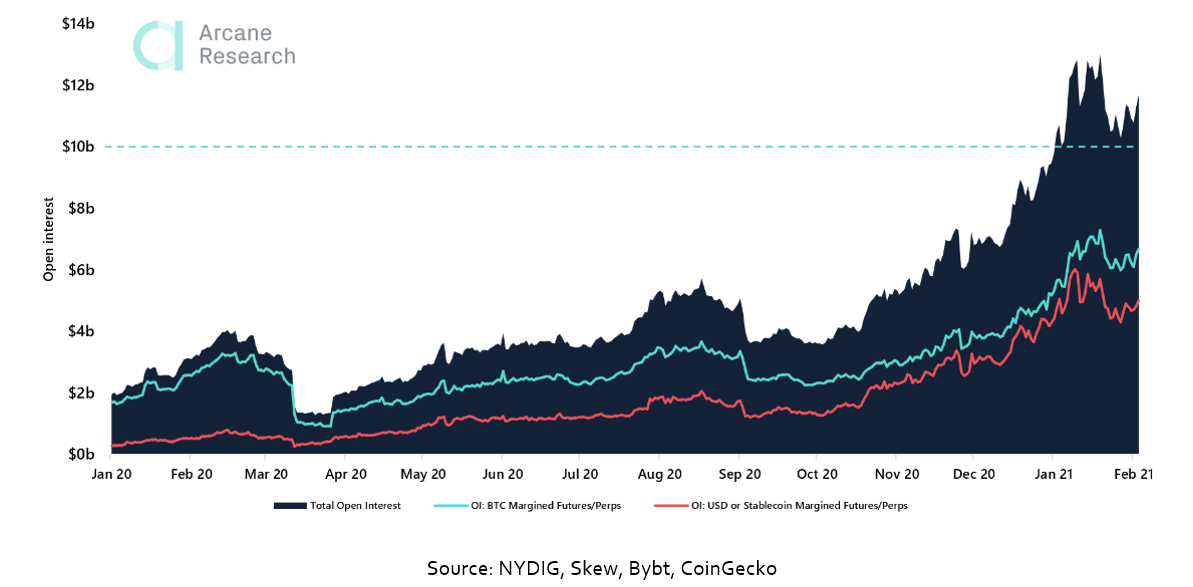

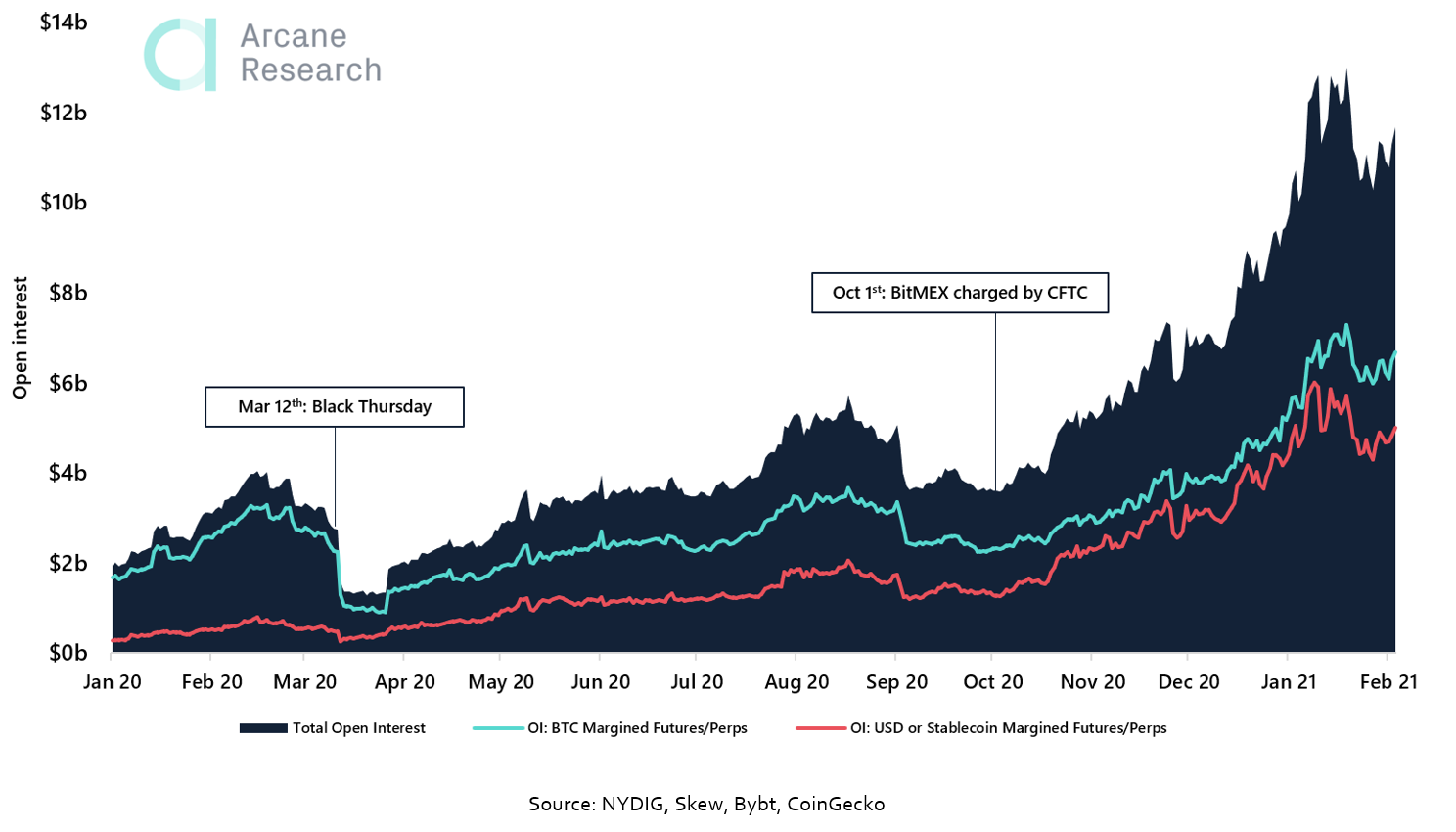

The BTC collateralized futures market has experienced strong growth since futures became more widely adopted between 2017 and 2018. However, throughout 2020, the BTC collateralized futures have lost massive market shares to its USD and stablecoin collateralized peers.In its essence, bitcoin collateralized futures exchanges work the following way: A trader post bitcoin as collateral and commits to a trade. If the counterparty defaults, the exchange act as a clearing house, seizing the position using auto-liquidation engines, stepping in to forcefully sell the trade in the market (if more collateral is not posted). Therefore, traders can decide to transfer additional collateral to the exchange and avoid liquidation. In other words, given Bitcoin's 24/7 up-time, traders can post more collateral at any time, if needed. Thus, traders can manage their margin balance in case the trade is about to become liquidated. Bitcoin-collateralized futures are inverse, meaning that the price is quoted in one currency, usually the dollar, and margined and settled in the base currency, bitcoin. Meaning that the traded contract is priced in USD but settled in BTC with the underlying contract being worth $1/BTCUSD, while the PnL calculations are priced in BTC.Trading on the futures exchanges is peer to peer. The counterparty is another trader, rather than the exchange itself. In a case of a massive, rapid price move, large numbers of bankruptcies may occur, resulting in a BTC deficit in the market. I.e., the funds are insufficient to cover the profits of the profitable traders. In this case, the deficit is proportionally distributed between the traders who made a profit that day. Meaning the traders get paid, but not the full amount. This process is called socialized losses. To prevent socialized losses, the derivatives exchanges have insurance funds. The insurance funds act as the last line of defense to prevent auto deleveraging. During normal volatility, the insurance fund is built up steadily by liquidating trades on the maintenance margin (0.5% of the margin). The open interest in the BTC collateralized futures market has trended upwards (when denominated in USD) ever since inception. As of Feb 3rd, around $6.7 billion worth of open interest was tied up in BTC collateralized futures trades. BTC Futures Market - Open Interest

Preview

Market composition: Bitcoin collateralized futures market

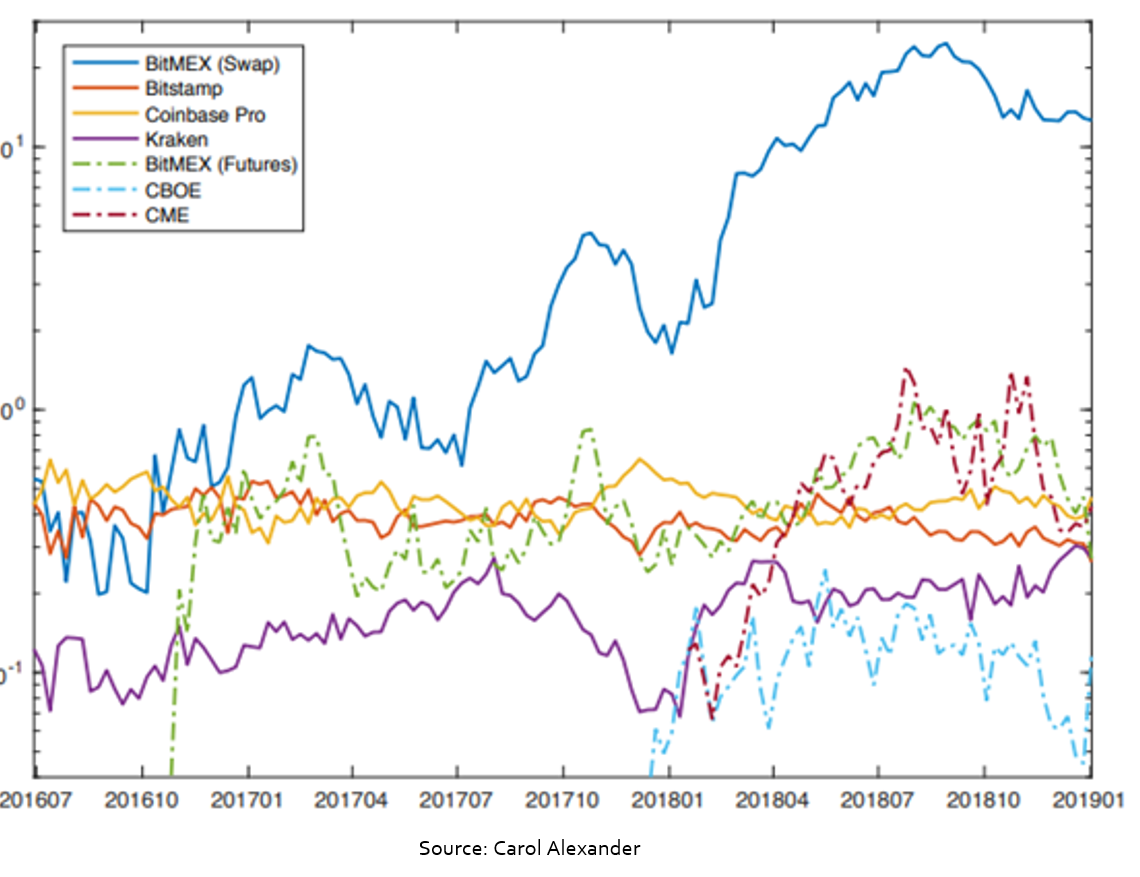

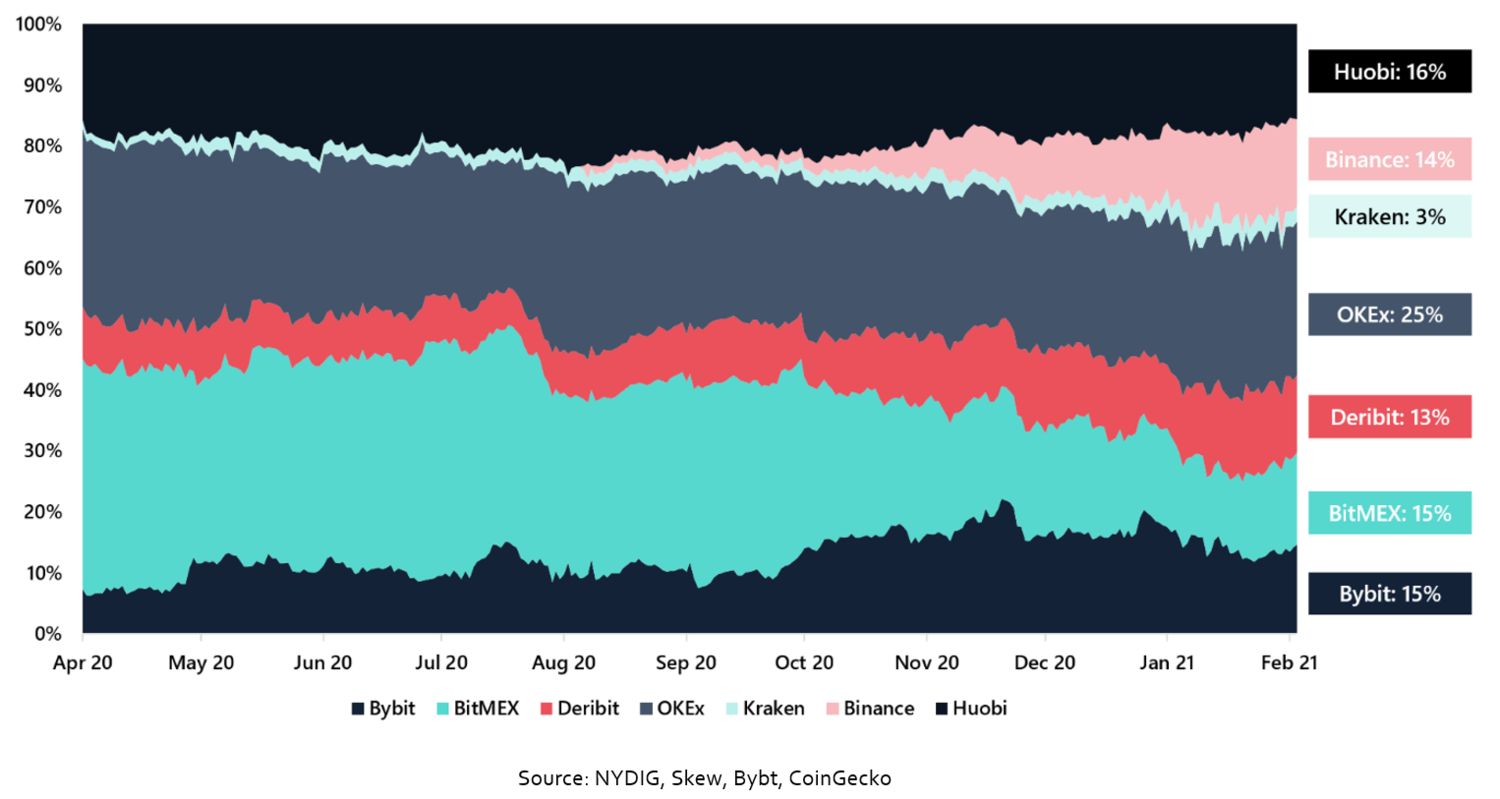

The bitcoin collateralized futures market blossomed during 2017 and 2018 and was then heavily dominated by BitMEX. In 2018, the trading volume of BitMEX surpassed the trading volume of the entire spot market. Now, there are many exchanges competing in the space, with OKEx being the largest exchange in terms of open interest in BTC collateralized futures.The bitcoin collateralized futures market is currently a space affiliated with fierce competition and many influential exchanges holding significant market share. The BTC collateralized futures market saw booming interest following the 2017 bull market, as traders sought to leverage their bitcoin to hedge and speculate amid the bear market. The market was then heavily dominated by BitMEX. The main reason behind BitMEX's dominance can be traced back to May 2016, when BitMEX launched the perpetual inverse swap contract (perp).The perp was an innovative derivative instrument. It shared most of the traits of traditional futures contracts while differentiating itself from futures contracts by not having an expiry date. By using funding rates, the perps maintain a close peg to the spot markets. This funding rate is the quintessential ingredient enabling the perps to trade without any expiry date. This quickly became a very popular derivative instrument in crypto, namely due to the convenience of not having to roll over any positions. According to a paper issued by Carol Alexander of University of Sussex Business School, the trading volume of BitMEX's perps surpassed those of the entire spot market in 2018, as illustrated in the chart below. Trading Volume of Different Bitcoin Products

Preview

Preview

Market sizing the bitcoin collateral held in the futures market

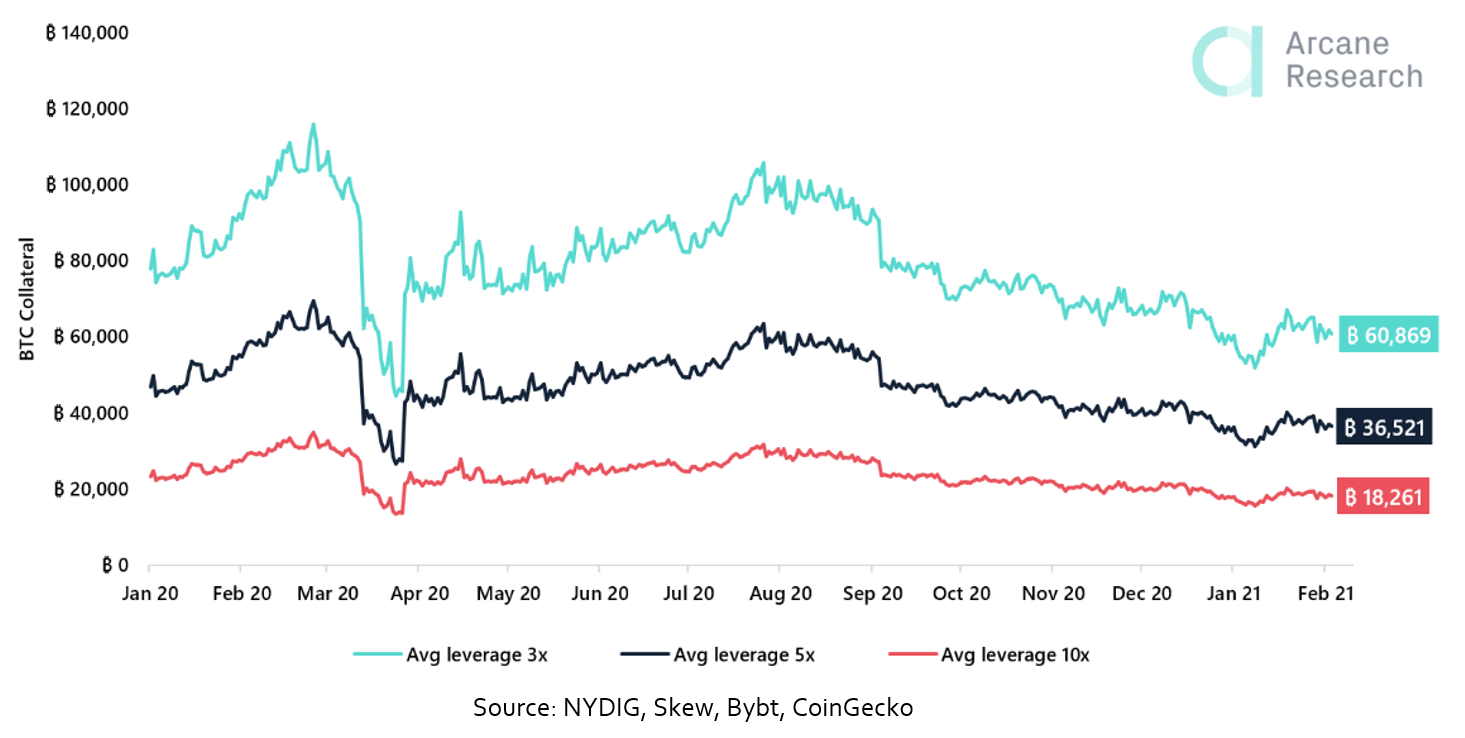

Our own calculations and estimations size the BTC collateral in the futures market to be somewhere between 18,200 and 60,000 BTC.The derivative market is relatively opaque. What we do know is the size of the open interest in the market. On February 3rd, 2021, the BTC collateralized futures market had a total of $6.7 billion worth of open interest or about 182 000 BTC. The open interest is not representative of the actual BTC held as collateral given that the futures markets are high leveraged. In order to estimate the size of the BTC collateral held by exchanges, we would either need to receive information from the derivative exchanges themselves on their AUM or the average leverage ratio of their positions in the market. Most exchanges were reluctant to disclose this information, so we're currently unable to conduct any precise information on the total collateral held on these exchanges. However, back in 2019, in a fresh breath of transparency, BitMEX published a blog on their leverage statistics from May 2018 to April 2019, disclosing the average leverage ratio of trades on the platform while also revealing the distribution of contracts held under various degrees of leverage.The reported weighted effective average leverage ratio trended between a whooping 15x-40x for the entire duration. However, a large bulk of the contracts traded on the platform were structured between 1-10x leverage. Given the maturing market and the lack of recent data, we will base our market sizing on a more conservative leverage ratio, and acknowledge that we might overstate the size of the collateral held on the derivative exchanges. Recently, Binance tweeted (and then later deleted) some stats that might indicate that these assumptions are too conservative.Below we've made a chart illustrating the amount of BTC held as collateral on the derivative exchanges under various leverage assumptions. Bitcoin Used as Collateral in the Futures Market (Various leverage assumptions)

Preview

Collateral discussion

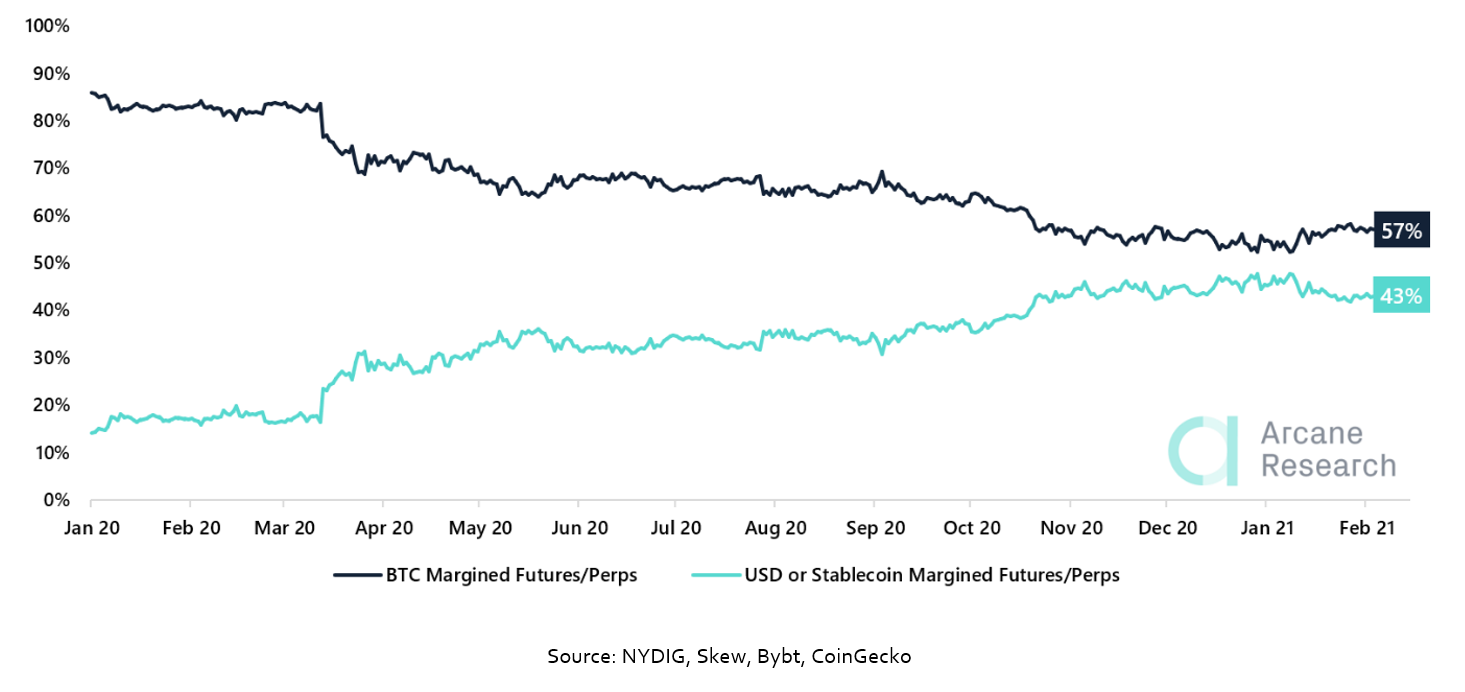

Stablecoin and USD collateralized futures have taken large market shares from BTC collateralized futures, and BTC collateralized futures now only account for 57% of the open interest in the futures market, compared to 86% on January 1st, 2020. As the derivative market in crypto has matured, more kinds of collateral have been introduced. With the launch of CME's BTC futures in December 2017, accredited investors could partake in leveraged bitcoin positions posting USD as margin (also settled in USD). Meanwhile, exchanges have also begun offering stablecoin-margined derivatives. The trend throughout 2020 has been that more traders have moved over to stablecoin and USD margined futures contracts, with bitcoin collateral losing major market shares the last year. This is illustrated in the chart below, showing that the total open interest of USD or stablecoin collateralized futures (teal) approaches the open interest of BTC collateralized futures. BTC collateralized futures now only account for 57% of the market.BTC Futures Market: Share of Open Interest by Contract Margin

Preview

Preview

Linear contracts

Firstly, the stablecoin-margined contracts are linear, meaning that exposure is constant, whereas the bitcoin-margined contracts are inverse. In a case where the trader enters a long position on an inverse contract and the bitcoin price declines, the underlying collateral for the trade will depreciate alongside the long position itself. As the value of the collateral declines, the risk of liquidation increases, meaning leveraged long trades on the inverse perpetuals are even more dangerous when collateralized in bitcoin than with stablecoins. The convexity of BTC margined contracts is unfavorable for longs.Absolute dollar return

Secondly, stablecoin margined perpetuals are used more for absolute dollar return, than they are for hedging market exposure, meaning they are more frequently used by speculators and arbitrageurs.Less complex

Thirdly, stablecoin-collateralized derivatives on altcoins are less complex than bitcoin-collateralized derivatives. Bitcoin collateralized derivatives on altcoin pairs are often solved by constructing quanto derivatives. They are collateralized and settled in BTC, but the underlying pair does not involve BTC. Meaning, that if a trader longs an ETHUSD quanto derivative, and ETHUSD goes up, while BTCUSD goes down, the trader realizes a BTC gain, but BTCUSD dropped, and in the end, her USD gain is much lower. Quanto contracts are thus more complex as they involve more variables, while stablecoin-collateralized trades are more straight-forward.These nuances could explain the 2020 trend of the market moving towards linear futures, highlighting that there clearly are some disadvantages to using bitcoin as collateral on derivatives. This has prompted both BitMEX and Deribit to seek to add new margin assets to their exchanges in 2021.“The focus for 2021 is on delivering the new products and features our growing client base has been asking for, including support for additional margin assets, expanding the list of contracts we offer, and integrating more closely with the infrastructure and services that have become core to the industry.” — Ben Radclyffe, Commercial Director at 100x Group

“In line with several of our peers we are preparing the introduction of stablecoin margined products, final introduction date to be confirmed.” — Luuk Strijers, CCO DeribitYet, while stablecoins have some advantages compared to BTC as derivative collateral assets, the picture is not all black and white.