A revisit of Arcane’s stablecoin predictions for 2022: Have they stood the test of time?

Examining Arcane Research's stablecoin predictions for 2022.Let’s rewind the clock to brighter times, when the not-so-transitory inflation had yet to fully unleash the enemy of all risk assets, higher interest rates, and before the turbulent past few months had yet to take place—namely, 2021-year end. A report then published by Arcane Research put forth a set of predictions for the upcoming year. With the first half of 2022 gone, let's revisit the three stablecoin predictions. Do they stand the test of time so far?Not all stablecoins are created equal

Before the predictions are presented and the development of the stablecoin sector thus far in 2022 is outlined, let’s remind ourselves of some basics. The cryptocurrency ecosystem represents a fast-moving frontier of financial innovation, and its complex relationship to the traditional financial system is often subject to misunderstandings among both its critics and advocates. Located close to the heart of this ecosystem and of this article, we find stablecoins. Stablecoins might not strike the everyday user as particularly important. After all, they only attempt to sit steadily at $1, day after day. In this way, they function as a safe harbor in a sea of otherwise volatile cryptocurrencies. Nonetheless, the belief that stablecoins have the potential to become the killer application that helps drive mainstream adoption of crypto is relatively common among industry participants. Endless stablecoin design architectures exist in practice—but, if we boil it down—three primary categories can be identified: fiat-backed, crypto-backed, and algorithmic stablecoins. Each design architecture has a set of associated tradeoffs that users should beware of. A brief walkthrough is provided below.- Fiat-backed stablecoins are backed 1:1 by traditional USD-denominated reserves. While being the most straightforward stablecoin design, their centralized nature introduces a need for users to trust the stablecoin issuer.

- Crypto-backed stablecoin use crypto reserves rather than fiat-denominated reserves. This design tradeoff, facilitated by on-chain crypto rails, allows a more transparent stablecoin with greater decentralization and censorship-resistant transactions. In short, they avoid third-party interference to a larger extent when compared to centralized fiat-backed stablecoins.

- Algorithmic stablecoins, also known as non-collateralized stablecoins, typically refer to a stablecoin that uses market incentives to maintain its peg instead of the typical reserves we see in other stablecoin types. They are the most complex, and by extension, typically are the most difficult to understand.

Now, let’s look at the predictions that were made.Arcane’s stablecoin predictions for 2022- The stablecoin supply will continue to balloon in 2022 – leading to increased regulatory scrutiny of stablecoins.

- USD Coin will overtake Tether’s position as the biggest stablecoin.

- Increased regulatory scrutiny of centralized stablecoins will lead to a massive growth of algorithmic stablecoins in 2022.

A quick description of the article's used methodology will first be provided before the pre-2022 stablecoin developments are outlined. Each prediction will subsequently be analyzed and judged. Each prediction's regulatory aspects will thereafter be bundled together and discussed before a summary is given at the end. Methodology

This analysis includes 13 of the largest stablecoins, as presented in the table below. These coins have seen their market dominance consistently fluctuate between 98% and 99% without any large deviations, according to data from DefiLlama, and therefore represent the de facto stablecoin market for the purposes of this post. The reader should nonetheless beware of the presence of multiple other stablecoins.Drawing an unambiguous line between different stablecoin categories is challenging. Deceptive marketing, whether intentional or unintentional, might hide the design tradeoffs of certain stablecoins—thus, their true underlying nature might be non-apparent to users. The newly launched stablecoin USDD highlights this issue. While the project is often described as an algorithmic stablecoin, this report classifies it as a crypto-backed stablecoin due to its BTC reserves, among other reasons. Moreover, DAI—which is supposed to be a decentralized crypto-backed stablecoin—is currently using tokens from centralized, fiat-backed stablecoins such as USDC and USDP as reserves. Centralized elements are thereby introduced to an otherwise supposedly decentralized project. As stablecoins entangle themselves in this way, they become even harder to distinguish. Nonetheless, for the intent of this analysis, the above-presented classification is used.Setting the stage: pre-2022 stablecoin development

Before we take a closer look at the market situation as we entered 2022, let’s examine how we got to that point. The issuance of newly minted stablecoins significantly increased in the aftermath of the COVID-19-induced market crash in March 2020. At this stage, uncertainty regarding future economic, social, and political development spread like wildfire. Market participants sought to de-risk their portfolios in this environment as asset correlations trended towards one. One way to achieve this was to change their balance sheet composition. Risky cryptocurrency assets could be exchanged for presumably less risky stablecoins. However, as market participants could purchase stablecoins on exchanges, this process does not necessarily increase the circulating stablecoin supply.Instead, the primary growth driver throughout 2020 and 2021 emerged from stablecoins ability to help market makers (MM)—composed of algorithmic trading firms, hedge funds, OTC desks, and prop trading houses—simplify their money transfer process between international exchanges. Since MMs generate revenue by providing liquidity to both sides of a trade to profit from the difference in the bid-ask spread, these simplifications created a more efficiently priced crypto market. But why?

Prior to stablecoins emergence, market participants used traditional wire transfers—a time-consuming process that stablecoins improved upon with their ability to provide rapid and transparent international settlements. Reduced barriers to capital movements made it possible for MMs to move funds more efficiently between exchanges—thus, they could develop new global trading strategies. As a result, crypto trading pairs on different exchanges saw increased price alignment as MMs profited by exploiting arbitrage opportunities. These activities propelled the overall stablecoin growth upwards throughout 2020 and 2021. Stablecoins also found an extensive array of new use cases through Defi in the summer of 2022, for instance, through lending and decentralized exchanges. Although the underlying causes almost always are multivariate, stablecoins entanglement into Defi undoubtedly supported the circulating supply growth. The circulating supply grew 8.7x from August 2nd, 2020, to January 1st, 2022. This corresponds to a 500% annualized growth. Against that backdrop, the stablecoin market was valued at $165bn as of January 1st, 2022—unaware of the soon-to-come growth trend reversal. Prediction 1: The stablecoin supply will continue to balloon in 2022 – leading to increased regulatory scrutiny of stablecoins.

In 2022's first four months, the supply growth from prior years continued at a slightly slower pace with 50% annualized growth vs. the previous 500%. This cryptocurrency equivalent of a “moderate” growth rate culminated with a supply peak of $187.4bn on April 25th.As April turned to May, the multi-year growth trend was abruptly disturbed by the meltdown of the algorithmic stablecoin UST. The event caused $18bn in stablecoin value to evaporate in just a few weeks, triggering further shockwaves as the resulting contagion spread throughout the industry.Without going into detail on that particular event—of which the curious reader can learn more here—the dust settling from UST's collapse in mid-May marked an inflection point. After facing the sharpest stablecoin drawdown ever, with the stablecoin supply having fallen to 160bn by May 15th—equivalent to a 3-week 14.6% supply reduction—the magnitude of stablecoin supply reduction decelerated. Between May 16th and July 1st, the overall supply dropped 5.4%, or 35.8% annualized. For the first time, we have seen sustained negative supply growth. At the end of Q2 2022, the stablecoin supply sat at $151.3bn, down $35.1bn, or 18.8%, over the last quarter. This is the largest quarterly drawdown in the history of stablecoins.The first half of 2022 saw stablecoin values equivalent to $13.7bn flushed away at an annualized growth rate of -16.1%, leaving stablecoins at around 17.2% of the aggregated $846.2bn crypto market cap as of July 1st. The three largest—Tether, USDC, and BUSD—all claim spots in the cryptocurrency top 10 list, with DAI lurking behind in 11th place. Is this a glimpse into the stablecoins future position within the crypto ecosystem?However, excluding UST from the calculations, we discover that 2022 has only brought a -2.6% supply reduction (-5.2% annualized), considerably less than the original -8.3%. This shows that UST was one of the main drivers of the observed fall in the circulating stablecoin supply.VerdictThe stablecoin balloon continued to inflate for a long time—including the first four months of 2022—before a rapid trend reversal. Thus, Arcane’s predicted stablecoin supply growth has not materialized so far. Let´s now move our attention to the battle between the two stablecoin behemoths—namely, USDT vs. USDC.Prediction 2: USD Coin will overtake Tether’s position as the biggest stablecoin.

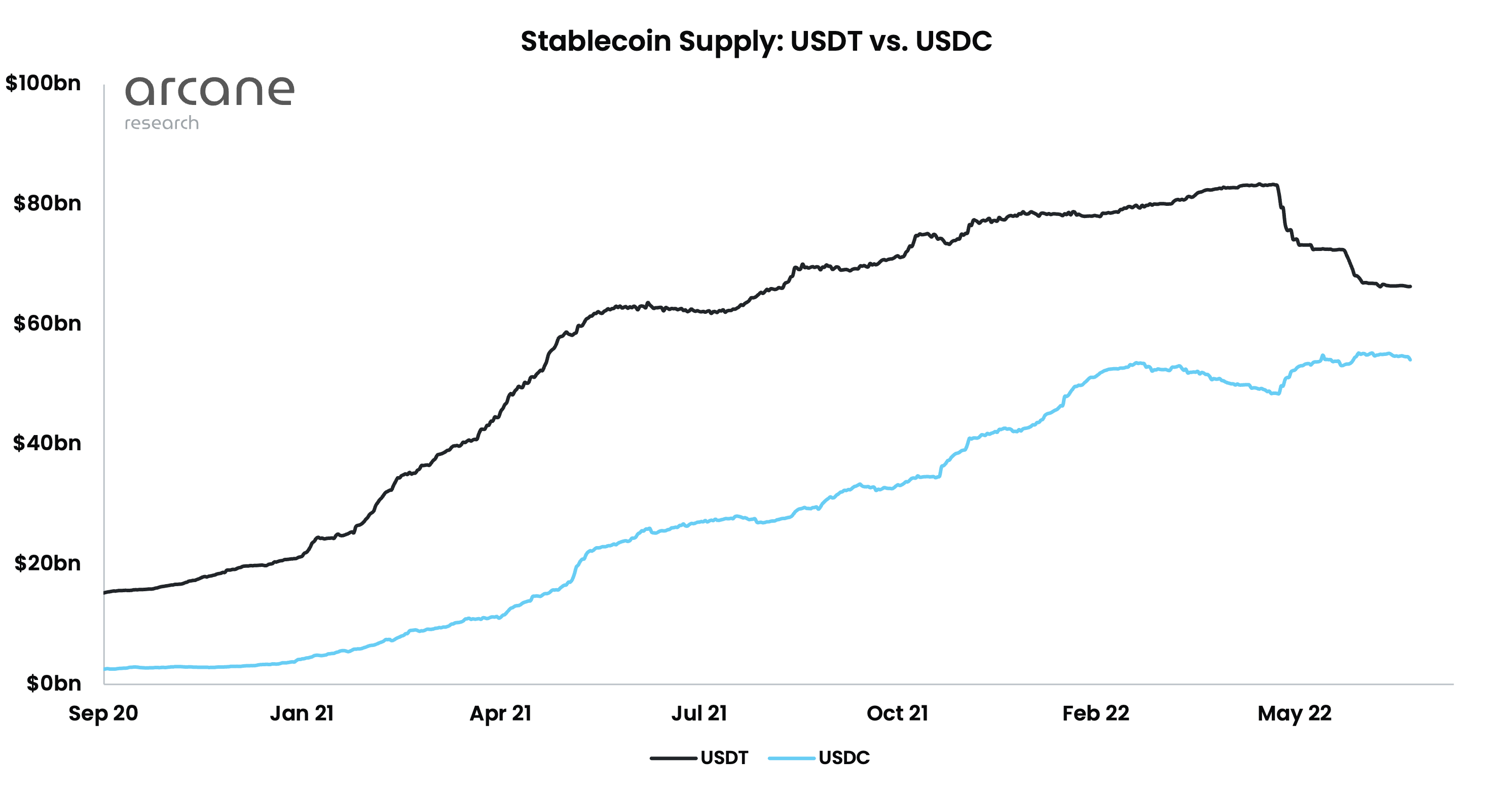

Interested parties can use multiple metrics to compare USDT and USDC in order to increase their understanding of how this duo develops over time across use-cases and sizes. Without going into detail in this article, which focuses on market cap and market dominance, such metrics include the number of users, number of transactions, and average/median transaction amounts, among others. Tether has, since its inception, consistently reigned as the undisputed stablecoin king—thus, they have successfully capitalized on their first-mover advantage. However, USDT’s market dominance was caught by a changing tide as it fell below 50% for the first time in November 2021. Since then, Tether has not been able to turn itself around, and 2022 has extended the decline further as the market cap has slipped from $78.4bn to 66.3bn. This -15.5% supply reduction corresponds to an annualized rate of -28.7%. In contrast, tether’s more regulatory-compliant rival, USDC, has blossomed in 2022. Its market cap has increased from $42.2bn to $55bn, an astonishing 70.4% annualized growth.While Tether started 2022 with a market dominance of 47.5%, USDC sat at 25.8%. With the first half of 2022 belonging to the past, Tether and USDC now have 43.8% and 36.3% market share, respectively. Thus, USDC is slowly but steadily closing in on USDT. But why has USDT’s circulating supply declined? This started as Tether de-pegged amidst the UST collapse in May. This presented an arbitrage opportunity for market participants with the ability to redeem USDT. They could purchase de-pegged USDT in the market, for instance, at $0.95, and subsequently redeem them at par ($1) to profit from the difference. A question then remains—when will USDC dethrone USDT by market cap?Let’s examine when this intersection point can be expected by assuming a continuation of the current growth rates of 70.4% (USDC) and -28.7% (USDT).By extrapolating these growth rates into the future, USDC would dethrone Tether’s position as the biggest stablecoin with a market cap of 61.3bn on October 10th, 2022. However, any interpretation or conclusion based on such growth rates should be made carefully due to the inherent uncertainty of future events. Nonetheless, it might remain an interesting data point to bear in mind.VerdictArcane’s prediction that USDC will overtake USDT is so far holding up. Based on current growth rates, USDC will seemingly emerge on top in mid-October.Prediction 3: Increased regulatory scrutiny of centralized stablecoins will lead to a massive growth of algorithmic stablecoins in 2022.

Simultaneously as the total stablecoin supply peaked at $187.4bn on April 25th, the market cap of UST hit $18.1bn. At this point, algorithmic stablecoins could claim a close to record-high 11.9% market share. As the year progressed, algorithmic stablecoins have seen their market cap plummet, falling from $13.3bn to $3.0bn—a 77.4% decline. Notably, UST’s collapse was responsible for $9.7bn, or 94.2%, of the drawdown that washed over algorithmic stablecoins.As a result, algo stables saw their market dominance fall from 8% to 2% between January and July 2022. This cleared the way for an 11.9% increase in fiat-backed stables' market share—led by USDC, alongside BUSD’s 21.9% market cap increase. Thus, algorithmic stablecoins have not seen growth in 2022 so far, at least as measured by aggregated supply.VerdictAlthough regulatory scrutiny of centralized stablecoins has picked up in 2022, this has not benefited algorithmic stablecoins as expected. Overview of Regulatory Dynamics

Arcane predicted that a ballooning stablecoin supply in 2022 would lead to increased regulatory scrutiny, which, in turn, would lead to the growth of algo stables. Although the expected supply growth is yet to unfold in 2022, context and nuance are essential to understanding the relationship between the increased regulatory scrutiny, stablecoins' supply growth and algorithmic stablecoins. Let's take a bird’s-eye view of the status quo. Viewed through a long-term lens, the massive supply growth has undoubtedly made regulators more aware of this part of the cryptocurrency ecosystem. However, it was not the ballooning stablecoin supply of 2022 that served as a regulatory catalyst. Instead, the algorithmic stablecoin UST's debacle sparked increased regulatory efforts to address stablecoin-related risks. Afterward, the G-7 Finance ministers called for accelerated global regulations on the cryptocurrency ecosystem. Furthermore, François Villeroy de Galhau, the French Central Bank governor, presented the UST collapse as evidence that stablecoins are “misnamed, and possibly very unstable.” Although it is undoubtedly true that stablecoins, in some instances, can be considered not-so-stablecoins, this depends on the stablecoin design—remember, they are not all created equal. The European Union recently reached a provisional agreement to create a unified regulatory framework for the crypto industry, known as the markets in crypto assets (MiCA) framework. While the proposal focuses on legal requirements for different variations of centralized stablecoins, it essentially makes it impossible for decentralized versions to comply with the framework. This can, to some extent, be explained by the fact that decentralized stablecoins—such as DAI, which is ranked 4th of all stablecoins—do not have an identifiable central entity. Furthermore, the United States seeks to regulate stablecoins as FDIC-insured institutions, as bills like the STABLE Act exemplify. This essentially attempts to pressure stablecoins and their unique characteristics into a not-so-suitable bank-regulation framework. Again, this would only be possible for centralized stablecoin issuers and could close the door for other stablecoin types. A scenario where the STABLE Act fails to achieve its goals could be envisioned. Excessive regulatory requirements could pressure centralized stablecoin issuer's profitability so far down that operating profitably could become impossible. This may create fertile ground for algorithmic stablecoins, which might rise back up as a regulatory pushback. This could, in turn, introduce other risk factors to the cryptocurrency ecosystem, as illustrated by the UST/Luna crash.Many other interesting regulatory developments exist, but these fall outside the scope of this article. A brief to-the-point summary of recent developments in crypto regulation in the UK, the EU, and the USA can be found here. Summary

2022 brought with it a flow of tumultuous events as crypto markets entered the seven seas. The combination of sour market conditions and increased regulatory efforts have pushed the stablecoin growth trajectory to negative territory for the first time in history. An essential question for industry participants is where we stand on the regulatory front. As we move forward, increased involvement from various regulatory bodies—particularly on stablecoins—should be expected. In a complex and fragmented regulatory landscape, regulatory clarifications would be welcomed by most, though it necessarily depends on the contents. Nonetheless, it would not be surprising to see the more regulatory-compliant USDC continue its strong growth relative to Tether before finally emerging on top by the end of 2022. Furthermore, the air in the algorithmic stablecoin balloon has deflated so far in 2022, with many industry participants writing them off by pointing to their inherently flawed design model. Continued experimentation and iteration with algo stables might someday yield results despite the limited success—to say it mildly—of current implementations.Moving forward, developments in the stablecoin market will likely have wide-reaching consequences for the crypto ecosystem—thus, they are worth paying attention to, for interested individuals. Final Note: Thanks to @VetleLunde and @JMellerud for valuable feedback on the article. Further feedback from readers on any noticed mistakes or inconsistencies would be appreciated.