Bitcoin miners can strengthen electricity grids

To safely integrate more wind and solar into electricity systems, the electricity demand must become more flexible. This article explains how the unique flexibility of bitcoin mining allows it to help strengthen electricity grids.This article is an excerpt from our research report titled "How Bitcoin Mining Can Transform the Energy Industry". The research report lays out five characteristics of bitcoin miners, which make them uniquely flexible energy consumers, and explains four energy problems bitcoin miners can help solve. This article explains one of these problems: How bitcoin mining can strengthen electric grids. Let's get into it.Electricity grids are becoming more fragile

The demand must always match the supply in electricity systems since even a slight imbalance can affect the system's reliability. In addition to altering the electricity supply or demand, energy storage and transmission lines can provide system flexibility. Historically, we have relied mainly on the supply side to adjust power generation to the expected demand.The different energy sources for electricity vary significantly in their controllability. Natural gas and hydropower are the most controllable energy sources since the energy producer can easily adjust their production up or down. Coal and nuclear are also controllable but to a lesser extent. They are very reliable, but granularly changing their production is inefficient. Coal and nuclear plants traditionally provided the baseload, letting natural gas or hydro plants fine-tune production to accommodate demand swings.One of today's biggest energy challenges is that the supply side's ability to provide system flexibility is decreasing. We are in the middle of an energy transition, replacing fossil fuels with renewable energy sources like wind and solar. These are non-controllable energy sources since their ability to generate electricity depends on weather conditions. Non-controllable energy sources can not be relied upon for system flexibility.

The International Energy Agency (IEA) operates with several scenarios for the energy transition. The Sustainable Development Scenario represents a gateway to the outcomes of the Paris Agreement, entailing massive growth in non-controllable energy sources as a share of the generation mix from 11% to 42% in 2040.Source: IEA (Sustainable Development Scenario) This scenario assumes a massive replacement of controllable with non-controllable energy sources. How do we replace this lost system flexibility? Our options are increasing the demand side flexibility, energy storage capacity, or transmission lines' capacity.We will need a combination of these options, but taking advantage of the demand side's flexibility stands out since it's cheaper and more scalable than the other alternatives.Flexible electricity consumers can provide demand response

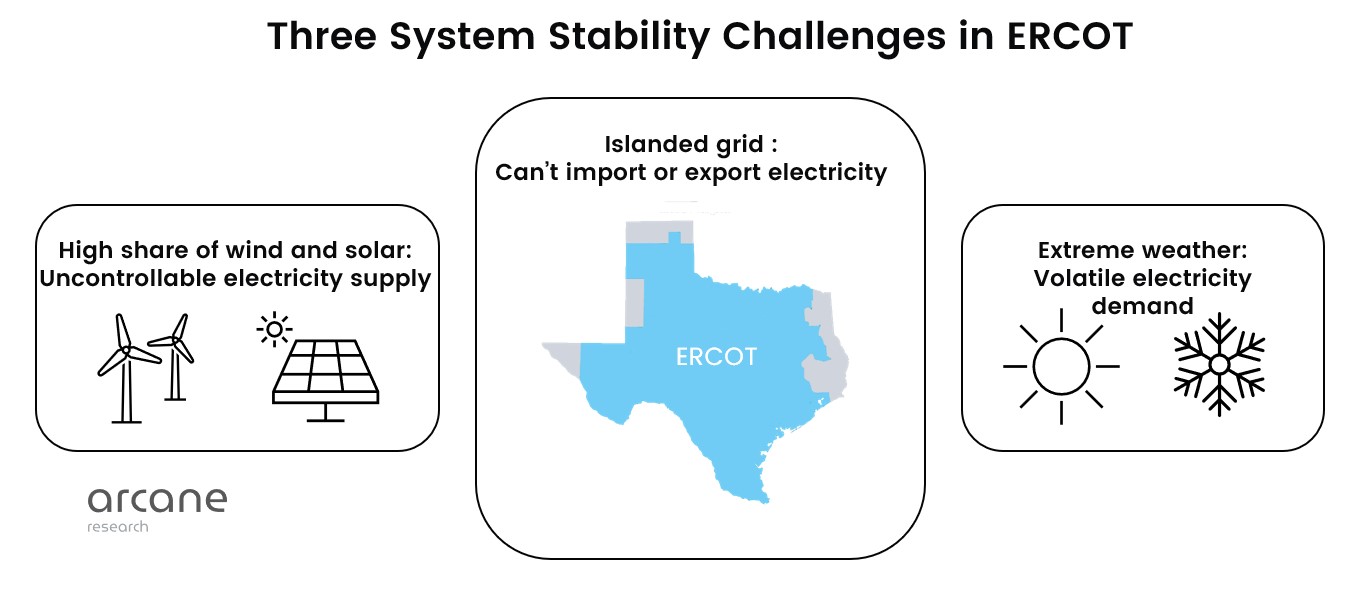

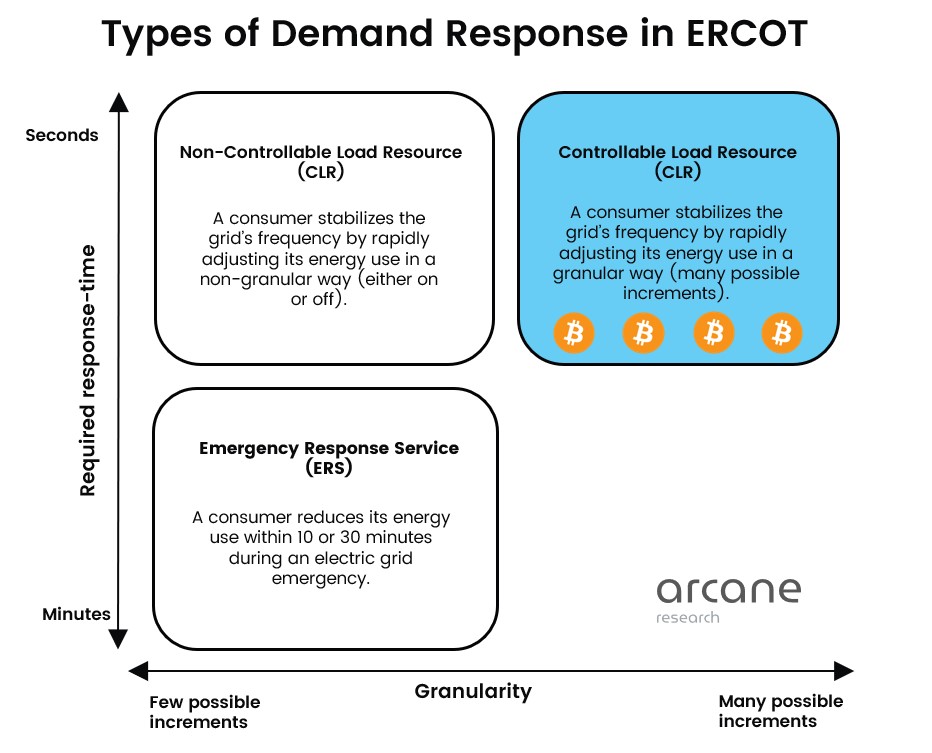

Demand response is a change in consumption by electricity consumers to match the electricity demand to the supply. The process typically involves payment or other financial incentives to consumers for agreeing to reduce their electricity use when supply is low.Demand response exists in most developed electricity systems globally. ERCOT, the electricity system in Texas, is at the forefront of demand response, and bitcoin miners have become one of their most trusted sources for system stability.The electricity system in Texas is called ERCOT, which is also the system operator's name. ERCOT faces a unique combination of challenges, incentivizing them to look for innovative ways to keep the electricity system reliable. The ERCOT electricity system is islanded, with almost no connections to other electricity grids. Importing or exporting electricity through transmission lines to provide system flexibility is, therefore, not possible.ERCOT has a high share of wind and a rapidly growing share of solar power, as Texas has among the best wind and solar conditions on the planet. The heavy reliance on wind and solar power means that the supply side is volatile, and they must increasingly rely on demand-side flexibility.Not only is the Texas grid islanded and has a high and rapidly growing share of wind and solar, but the Texas weather can be extreme and unpredictable, leading to volatile demand. An example is the winter storm in February 2021, which led to skyrocketing demand and supply outages.This combination of system stability challenges has incentivized ERCOT to develop one of the most advanced demand response markets globally. ERCOT has two main categories of demand response depending on how fast the demand response resource must adjust its electricity consumption. The first category is called load resource, and the other is emergency response service.The load resource designation allows eligible demand response resources to help stabilize the grid's frequency. The frequency fluctuates around 60 Hz in North America, and keeping it as close as possible to this level is essential. A high load relative to generation decreases the frequency, while the opposite increases it. The system operator continuously monitors the frequency and employs various tools to stabilize it.We can break the load resource designation into two types: Controllable Load Resource (CLR) and Non-Controllable Load Resource (NCLR). To earn these designations, loads must pass several tests regarding their controllability. As the names suggest, the controllable load resource designation has higher entry requirements than the non-controllable load resource.Controllable load resources are loads that can granularly adjust their load within seconds, allowing them to take active roles in balancing the grid's frequency. Non-controllable load resources also help stabilize the frequency, but only in a binary way by tripping the whole load offline if the frequency drops below a certain level. The higher controllability of controllable load resources means that these demand response resources are much more efficient in stabilizing the grid than non-controllable load resources. So far, only crypto miners have earned the controllable load resource designation.While load resources provide the first layer of protection for the grid by regulating their load to stabilize the frequency in seconds, one additional layer of protection is employed if the load resources are insufficient. This final level of grid insurance is called Emergency Response Service (ERS) and consists of loads that can reduce their electricity usage within 10 or 30 minutes, depending on agreements.Demand response generally works by electricity consumers selling their ability to shut down operations in various day-ahead markets for ancillary services. They then reduce their electricity consumption per this agreement if the system operator orders them. We can view this arrangement as demand response resources selling insurance to the grid.Demand response can also be provided simply by reacting to price signals. If the electricity price is high during specific periods, flexible consumers can restrain from buying during these times. By avoiding consumption during expensive hours, a consumer effectively acts as a demand response and alleviates pressure on the system.Bitcoin mining is the best alternative for demand response

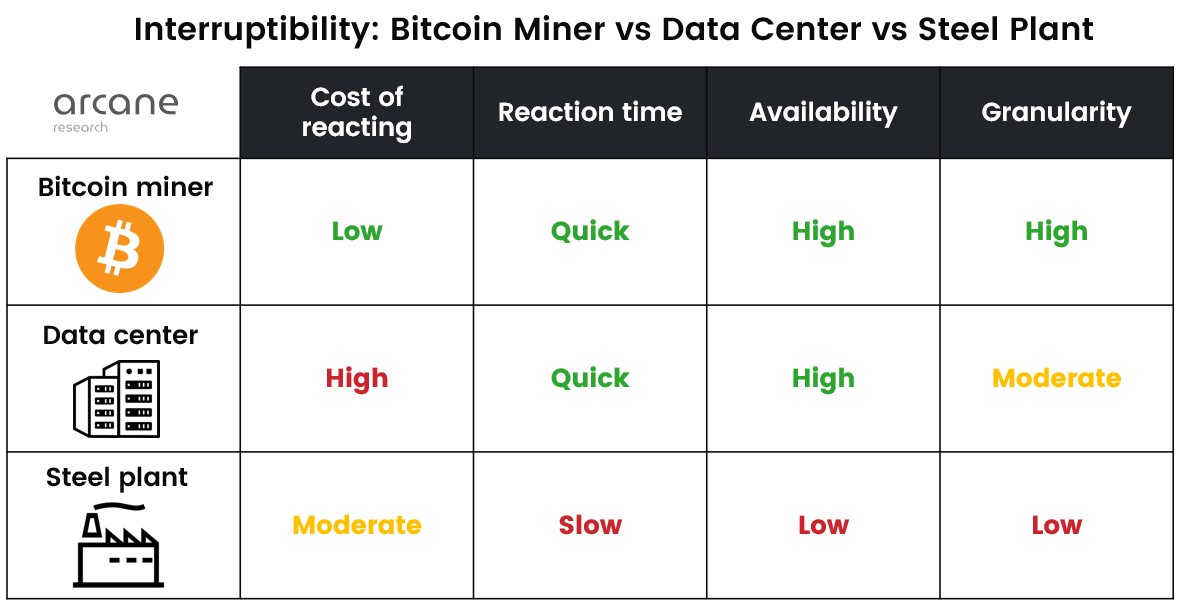

ERCOT created the controllable load designation in 2004. No electricity consumers fulfilled the requirements until 2020, when the demand response technology company Lancium and a bitcoin mining load passed the necessary tests. Lancium's patented Smart Response® software allows bitcoin miners to act as controllable load resources.Bitcoin miners designated as controllable load resources are allowed to participate in all of ERCOT's ancillary services markets, where they sell their ability to regulate their power consumption following instructions from ERCOT. They can also participate in real-time power markets, allowing them to include a clause in their power purchasing agreements to power down and "sell" power back to the grid for the real-time price of electricity.According to ERCOT, there are currently eight crypto miners with a total capacity of 750 MW designated as controllable load resources, with an additional 2600 MW awaiting approval. However, Rich Godwin, a Texas bitcoin miner, tracks the real-time participation of controllable load resources daily and has only seen about 130 MW. This difference might be due to not all controllable load resources participating in the market simultaneously.Why have only crypto miners passed ERCOT's controllable load resource requirements? It all comes down to bitcoin mining's uniqueness as an interruptible load, which we explained in this article. We will now build on that analysis by dissecting four factors that make a load interruptible, comparing bitcoin mining's score on these factors with that of two other energy-intensive consumers: A conventional data center and a steel plant.Cost of reactingThe cost of reacting refers to a demand response resource's costs of powering down its operations. This number is very high for a conventional data center since it serves clients that depend on available data, making it unsuitable for providing demand response.For bitcoin miners, the only cost of reacting is the alternative cost of not producing bitcoin, giving them high economic incentives to provide demand response. Suppose the price per MWh exceeds what the miner could have earned by dedicating this MWh to mining bitcoin. In that case, the miner should stop mining since it will gain more by turning off its machines than by mining bitcoin.The chart above shows that in 2022, the alternative cost of not dedicating a MWh to bitcoin mining has fluctuated between $150 to $300. In times of grid stress, when demand response is needed, the real-time power price can reach thousands of dollars per MWh, substantially higher than this alternative cost, meaning that economically rational bitcoin miners will turn off their machines.Reaction timeThe second factor, reaction time, is how fast the demand response resource can power down its operations. A steel plant has a slow reaction time since it takes a lot of coordination to power down a factory with many different processes and employees. On the other hand, a bitcoin mining facility only does one function, solving the SHA-256 hashing algorithm. This single process can rapidly be interrupted, allowing bitcoin miners to participate in demand response programs requiring the fastest reaction times.AvailabilityBecause of the stability of a bitcoin miner's load, a system operator can always rely on the bitcoin mining load to be available to provide demand response when needed. An example of an industrial load with low availability is a steel plant. Steel production consists of many processes; only a few are energy-intensive enough to provide demand response. Since these processes demand different amounts of energy, a steel plant's load will fluctuate daily and weekly. It can not always be relied on to provide demand response.GranularityGranularity refers to how many increments the demand response resource can adjust its load. A bitcoin miner can adjust its load in almost infinite increments and is therefore highly flexible in the amounts of electricity it can sell to the grid. The high granularity of a bitcoin miner stays in stark contrast to a steel plant, which either runs its electric arc furnace or not.Scoring high on reaction cost, reaction time, availability, and granularity makes bitcoin mining a highly interruptible load, which is why it is the only controllable load resource in ERCOT.Examples of bitcoin miners stabilizing the grid

The point of demand response is to protect the grid during high-stress events when there is not sufficient generation compared to the load. Then it makes the most sense to look at what bitcoin miners did during the most high-stress event on the Texas grid in history: the winter storm Uri in 2021.From February 13th to 19th, a severe winter storm hit Texas. ERCOT had not prepared for such a black swan event, and the winter storm led to widespread outages of generation and natural gas supply. The combination of generation outages and skyrocketing electricity demand from homes needing heating caused a severe imbalance between supply and demand. Real-time electricity prices soared to more than $9,000 per MWh.To reduce electricity demand and mitigate the impacts of the catastrophe, ERCOT deployed all its demand response resources, of which many were bitcoin miners. These bitcoin miners voluntarily turned off their machines and sold their unused power back to the grid. Meanwhile, the state's conventional data centers didn't turn off.The chart above compares West Texas's average real-time power price for each day in February 2021 with the turn-off points for bitcoin mining and residential customers. Residential customers are non-price responsive since they need the energy for essentials like heating, meaning that they will generally not stop consuming energy even when prices soar. On the other hand, Bitcoin miners are very price responsive since they know precisely how much they earn per MWh.During the 7-day winter storm, the average ERCOT power price was $5,972 per MWh, far above the bitcoin mining revenue per MWh of $480. The economic incentives are clear: A bitcoin miner that didn't turn off his machines during the winter storm would have spent nearly ten times more on electricity than this electricity would have earned him in revenue.ERCOT also suffered a winter storm in 2022, which was not nearly as bad as the year before, but the system operator still had to deploy some of its demand response resources. Riot Blockchain was among the miners that powered down its operations.20 Bitcoin miners have become ERCOT's most trusted demand response resources, confirmed by the interim CEO of ERCOT, Brad Jones, saying in an interview with CNBC that "crypto miners help ERCOT keep renewable energy operational.Bitcoin mining provides the demand flexibility needed to integrate renewable energy safely

Demand response will be an integral tool to secure the reliability of electricity systems as we continue integrating variable renewable energy sources like wind and solar. The IEA estimates that to reach the Paris Agreement, we must bring a total demand response capacity of 500 GW to market by 2030, corresponding to a 10x growth from 2020.Source: IEA (Net Zero Scenario) Bitcoin mining is an energy-intensive and stable load that can be rapidly adjusted up or down with extreme precision at no extra cost other than the alternative cost of not mining bitcoin. The combination of these traits makes bitcoin mining a uniquely interruptible load and our best alternative for demand response, providing the demand flexibility needed to integrate variable renewable energy safely.