How large is Georgia's bitcoin mining industry?

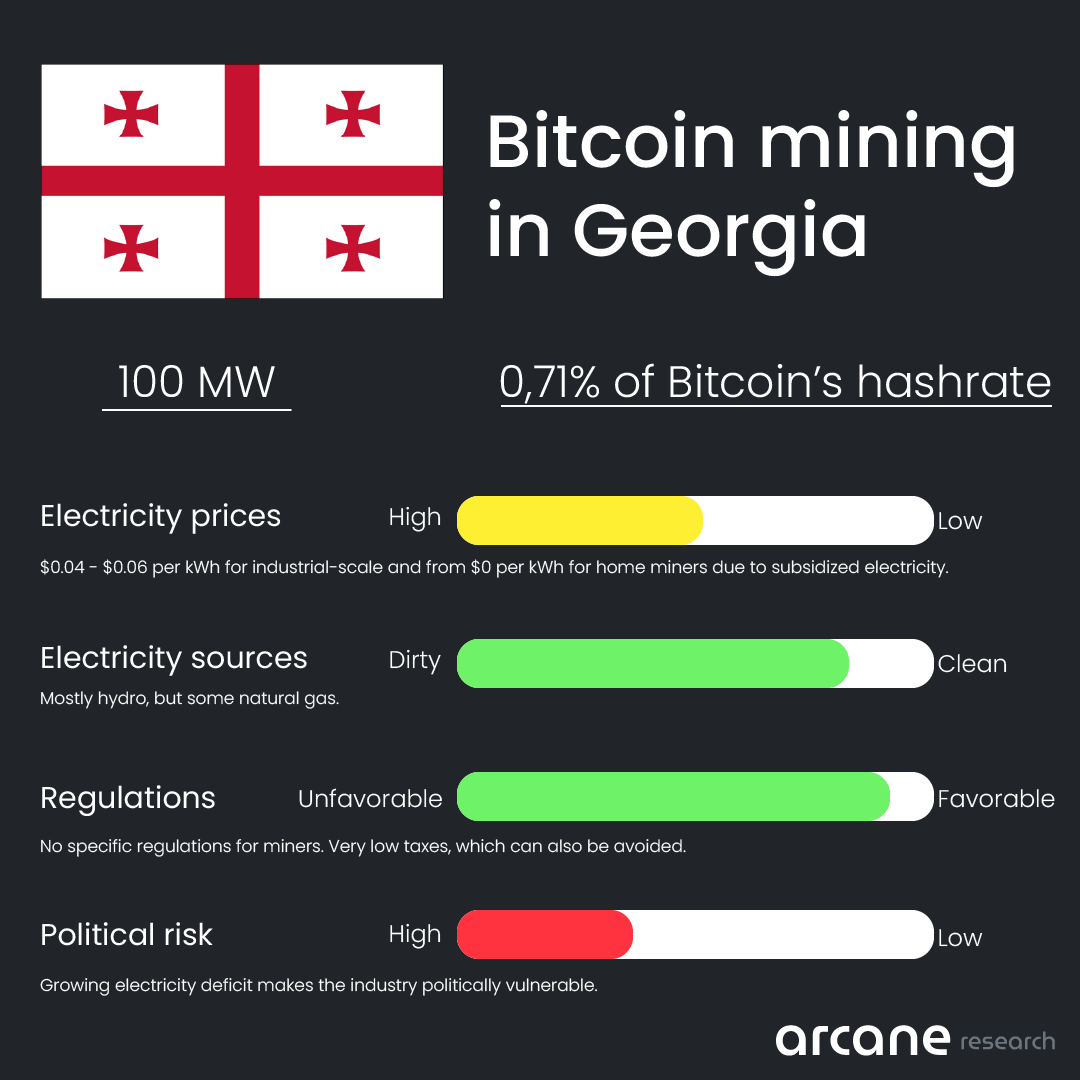

According to the most recent edition of CBECI's mining map, Georgian miners produce 0.18% of Bitcoin's hashrate. I believe the country's actual bitcoin mining capacity to be far higher than this estimate. Why?CBECI uses data from mining pools to estimate the geographic distribution of miners, but the sample only includes four pools that together account for 34% of Bitcoin's total hashrate. CBECI openly admits that their sample may not be sufficiently representative, but it's still the best estimate we have.If Georgian miners are not heavy users of the pools included in CBECI's sample, their geographical share of Bitcoin's hashrate will be underestimated.During my stay in Georgia, I befriended miners and often visited mining facilities. These miners have told me Georgia has at least 125 MW of crypto mining capacity. I have identified 62 MW from industrial-scale data centers. The remaining 63 MW should then come from lots of small amateur setups scattered around the country in homes, garages, and abandoned warehouses and factories.CBECI (Feb 15th) estimates the Bitcoin network to draw 14 GW of electricity. Based on information from Georgian miners, I estimate that 100 MW of Georgia's 125 MW total crypto mining capacity is dedicated to Bitcoin and that Georgia's hardware is as efficient as the network average. In that case, Georgia should produce about 0.71% of Bitcoin's total hashrate, multiples higher than CBECI's 0.18% estimate.Who mines bitcoin in Georgia?

The international bitcoin mining giant Bitfury has since 2016 operated a 55 MW facility in the outskirts of the capital, Tbilisi. The facility consists of standard halls filled with air-cooled machines as well as containers with immersion cooling systems - an advantage in Georgia, where summer temperatures often spike above 40°C.

Preview

Preview

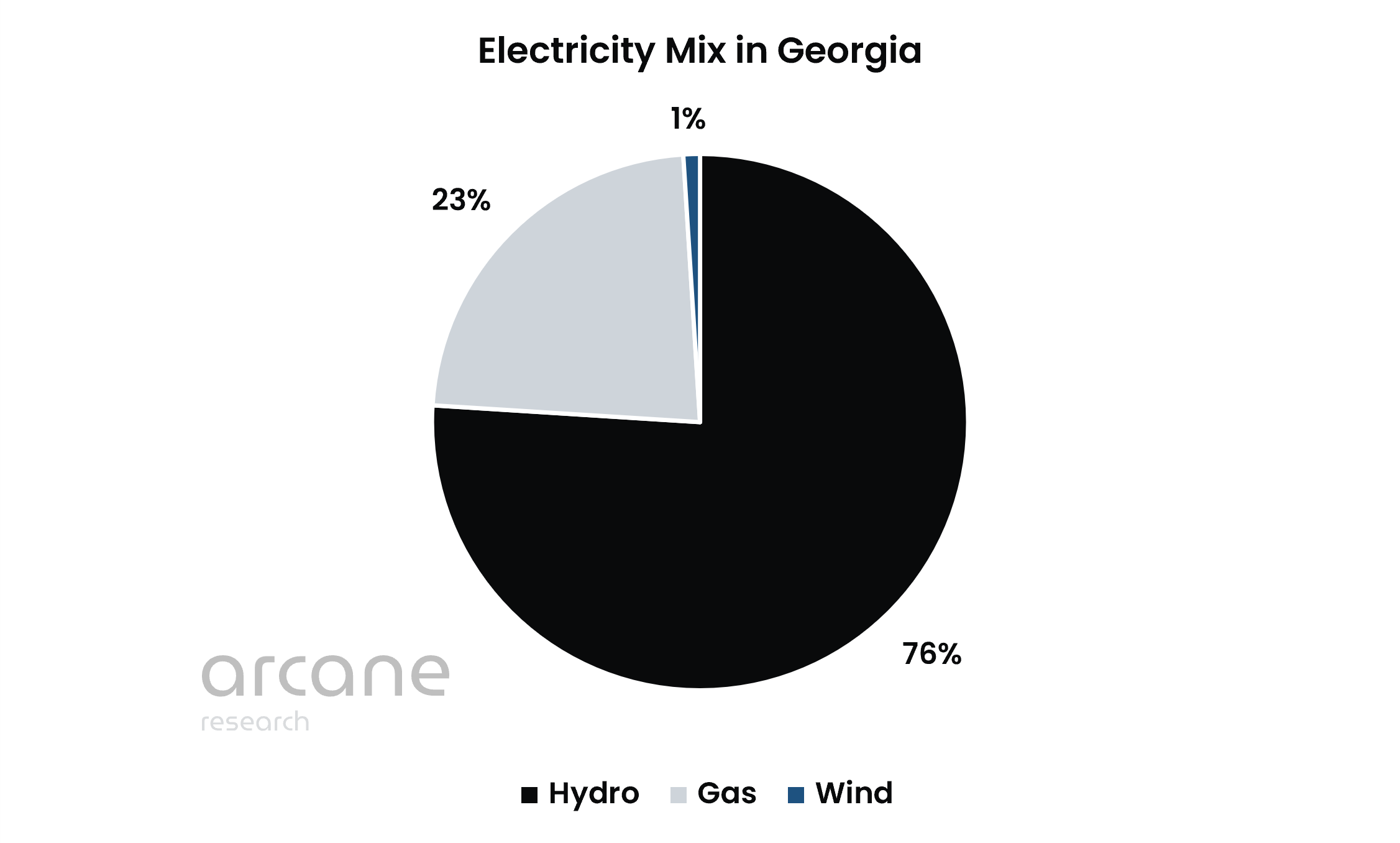

Electricity mix

Mountainous Georgia has access to enormous amounts of hydroelectric power. Go for a drive through the country, and you will pass countless rivers and several sizeable hydropower plants. According to Our World In Data, the country generates 76% of its electricity from hydro, 23% from natural gas, and 1% from wind.

Preview

Preview

Electricity prices

Electricity is generally cheaper in Georgia than in most countries. Industrial-scale miners can achieve a price of around $0.04 - $0.06 per kWh - slightly above the median electricity price in the industry (Bitooda).Electricity has become more expensive in Georgia over the last few years. Existing industrial-scale miners that were early entrants in the electricity market could secure long-term contracts priced cheaply, and it's unlikely whether new entrants will be able to secure such favorable-priced power contracts.Electricity is cheaper in remote, mountainous regions because of government subsidies. In some areas, like the disputed area of Abkhazia, electricity is free of charge. Still, industrial-scale miners can't expect to enjoy subsidized electricity, certainly not in the long term.Rising electricity deficit

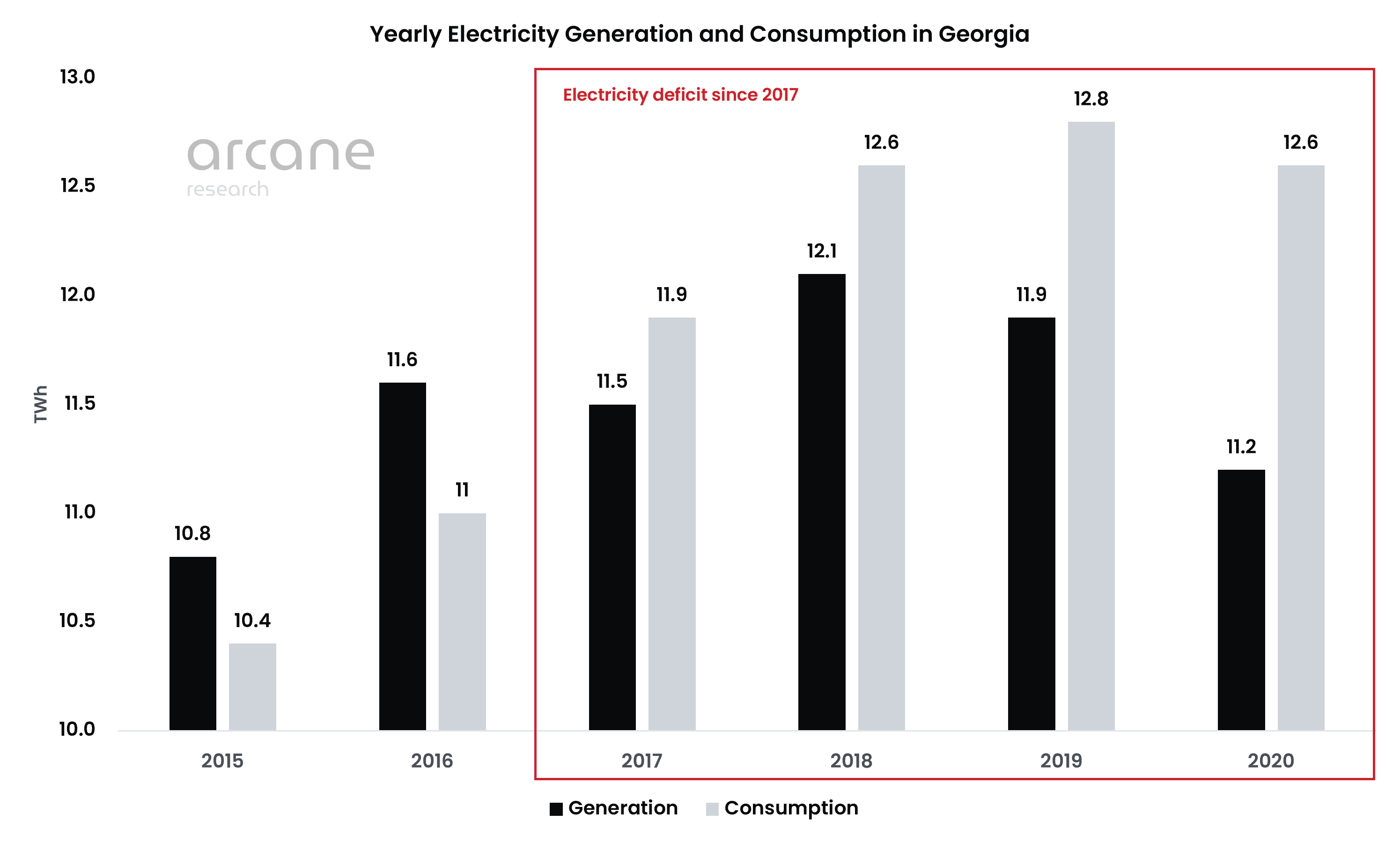

The country's failure to build new generation capacity, coupled with rising electricity demand - partly caused by the unexpected growth of crypto mining - is leading electricity prices to rise. Until the country develops more generation capacity, electricity prices will continue increasing.We can see the imbalances between generation and demand in the chart below. Georgia has historically been an electricity exporter but has from 2017 been a net electricity importer.

Preview

Potential for development of new electricity generation

It's estimated that the electricity deficit will continue growing, so to avoid upwards spiraling electricity prices, Georgia must develop new hydropower plants. The potential here is enormous, but a general opposition among the population currently holds back new hydropower projects. Many Georgians have ties to regions that new hydro projects will dam up. During my six-month stay in Georgia, I witnessed at least two large protests against new hydro projects. In addition, hydropower plants are enormous infrastructure projects that take several years to develop.

Preview

Regulatory environment

Georgia has low taxes and a very relaxed regulatory environment. The country's business friendliness fascinated me long before I decided to move there, and I wondered how a former Soviet country became such a libertarian enclave.During the 1990s, in the chaos that unfolded after the Soviet Union collapsed, Georgia went through some hard years that included a civil war. The apocalyptic period spurred a revolution in 2003, leading to the election of visionary Mikheil Saakashvili as president.Having been locked behind the iron curtain for 70 years as part of the Soviet Union, the Georgian people thirsted for freedom. The newly elected Saakashvili's procedure was to remove all regulations and taxes unless they were considered absolutely essential. They effectively cut 80-90% of all regulations in a few months, lifting away an enormous bureaucratic burden from the country's shoulders.The reform was a massive success, and the country's economy has been among the fastest-growing globally since. In 2019, Georgia ranked seventh on the World Bank’s Ease of Doing Business Index, higher than the likes of United Kingdom, Germany, Norway, Sweden, and Australia. Georgia's transformation is awe-inspiring, considering it was extremely poor and plagued by lawlessness just 20 years ago.Having little bureaucracy to deal with is helpful for any business, but the most important regulatory aspect for a bitcoin miner is the ease of getting electricity and how the electricity market is regulated.In the past decade, Georgia's electricity sector has been transformed from a vertically integrated single-buyer structure into an unbundled system with significant private sector participation in generation and distribution. The country is in cooperation with the EU developing a new market model with more competitive and transparent rules for power trading, and its goal is to meet all EU power sector standards by 2025. These initiatives will deregulate the electricity market even further.In Georgia, anyone is free to buy electricity from anyone. Bitfury has a direct power purchasing agreement with a power producer and owns a substation, allowing them to avoid dealing with the distribution companies, saving on distribution charges.A tax haven for bitcoin miners

Another regulatory advantage in Georgia is low taxes, specifically on cryptocurrencies. There are no specific regulations on cryptocurrency mining or trading, so miners can operate as they please. Individuals in Georgia are exempt from taxes on mining or trading cryptocurrencies, but businesses generally have to pay a 15% corporate income tax and 18% VAT.For export businesses, it's possible to avoid most taxes by setting up the business in one of Georgia's four free economic zones, specifically designed to minimize taxes for export companies to help them successfully compete in global markets. Bitfury’s facility is located in the Tbilisi Free Zone, letting them avoid corporate taxes, VAT, import taxes, and other fees.These free economic zones are highly relevant for bitcoin miners since they compete against miners worldwide, and the only way to stay long-term competitive in this industry is to minimize costs, including taxes.

Preview

Political risk

Yes, the country has little bureaucracy, low taxes, and a relaxed regulatory environment. Still, bitcoin mining is an industry that is vulnerable to political risk since it's often used as a scapegoat in countries with fragile grid systems. We have seen that happen in many countries before, like Kazakhstan, Iran, and Kosovo.Assuming that the crypto mining industry in Georgia draws 125 MW, the industry uses around 9% of the country's electricity. IEA's estimate is even higher at 10-15%. Regardless if its 9% or 15% - it's a substantial amount, which increases the country's reliance on imports in the winter and can potentially weaken its energy security and increase electricity prices for the average consumer.The vast size of the industry compared to the country's small size may put a barrier to the industry's potential growth. Both because more mining will increase electricity prices and make new mining projects unprofitable, but also because the government might turn against the industry if it becomes advantageous for them.The political risk is higher in some regions of the country than in others. Because the governments in mountain regions subsidize electricity, thousands of people have started small home mining operations, allegedly leading some towns to consume four times more electricity than expected, which has led to efforts to reduce mining. One such effort was when churchgoers had to swear an oath to St. George that they would not mine cryptocurrencies.Especially in the disputed area of Abkhazia, there have been problems with the grid, as they have periodically suffered rolling blackouts during the last year. These problems were caused mainly by their biggest hydropower plant being shut down for maintenance for three months and the higher than usual electricity demand from countless small home mining operations. The rolling blackouts have led to public anger in the region, which is not sustainable since miners are easily blamed. In Abkhazia, the government relies on subsidizing electricity to gain support. Mining threatens this strategy, so it's no surprise that the government cracks down on mining in areas with subsidized electricity.Conclusion

With its cheap and clean hydroelectric power, tiny, mountainous Georgia has attracted a large bitcoin mining industry with industrial-scale operations and countless small home mining setups.The country's relaxed regulatory environment and low taxes have helped it rank seventh in the World Bank's ease of doing business index, making the country attractive not only for bitcoin miners but also for any business.Georgia is a strong crypto adopter, and people generally have a positive attitude towards the emerging asset class. Nevertheless, the political risk is considered high because of the country's significant and growing electricity deficit, incentivizing the government to crack down on miners. In addition, home mining operations challenge the government's electricity subsidy strategy in some areas of the country. Therefore, the country's favorable regulations for miners may change in the future.Since Georgia recently has become dependent on electricity imports, there might not be room for more bitcoin mining until new generation capacity is developed. Still, opportunities exist for miners to contribute to building out new electricity generation, especially wind power.

Preview