Bitcoin on-chain summary: Hashrate is stagnating

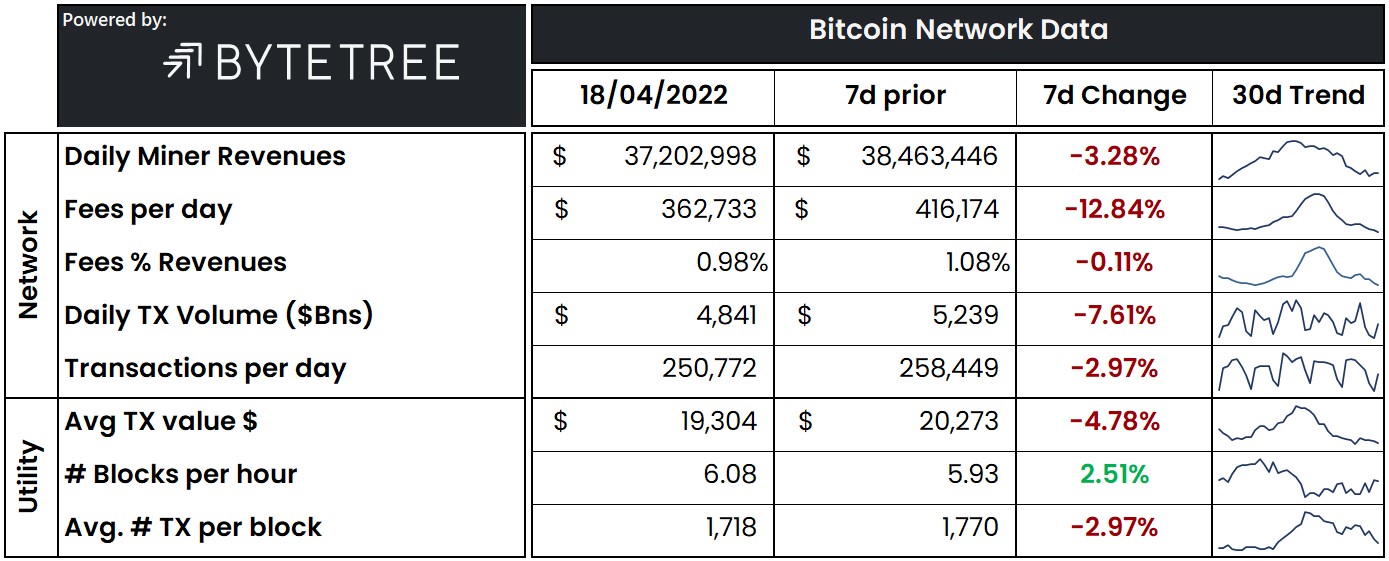

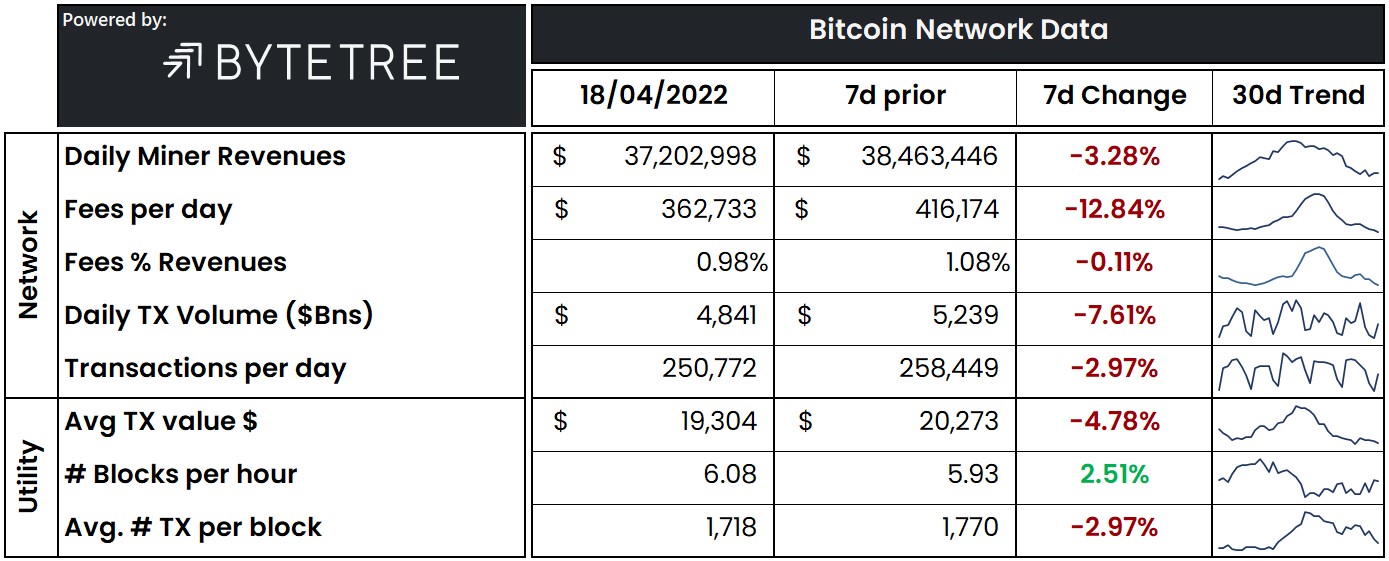

Bitcoin's on-chain activity continues decreasing, and the miners keep on with their slow pace in getting hashrate online.Daily miner revenues briefly topped above $40 million at the beginning of April but have kept on dropping and are now $37 million. Mining profitability is now close to 12-month lows.While the lower bitcoin price is the primary cause for the current low miner revenues, another reason is the minuscule transaction fees, currently making up less than 1% of the miner revenue.There are several reasons why transaction fees are so depressed. Transaction fees tend to get elevated during periods of retail hype. The Fear and Greed Index is definitely not indicating such a period at the moment.Other reasons for the current low transactions could be increased SegWit adoption and elevated use of transaction batching by the exchanges.In addition, the demand for making micro on-chain transactions is decreasing as the adoption of the Lightning Network is rising. Learn more in our updated Lightning report.Since July, the beginning of March, the difficulty has surged almost 50%, with 16 of 20 difficulty adjustments being positive. Since the beginning of March, three out of four difficulty adjustments have been negative, showcasing how the hashrate has stagnated.Miners with plugged-in ASICs welcome the stagnating hashrate since margins are already compressed in the ultra-competitive mining industry.