Bitcoin’s transaction fees plummets to April 2020 bottom

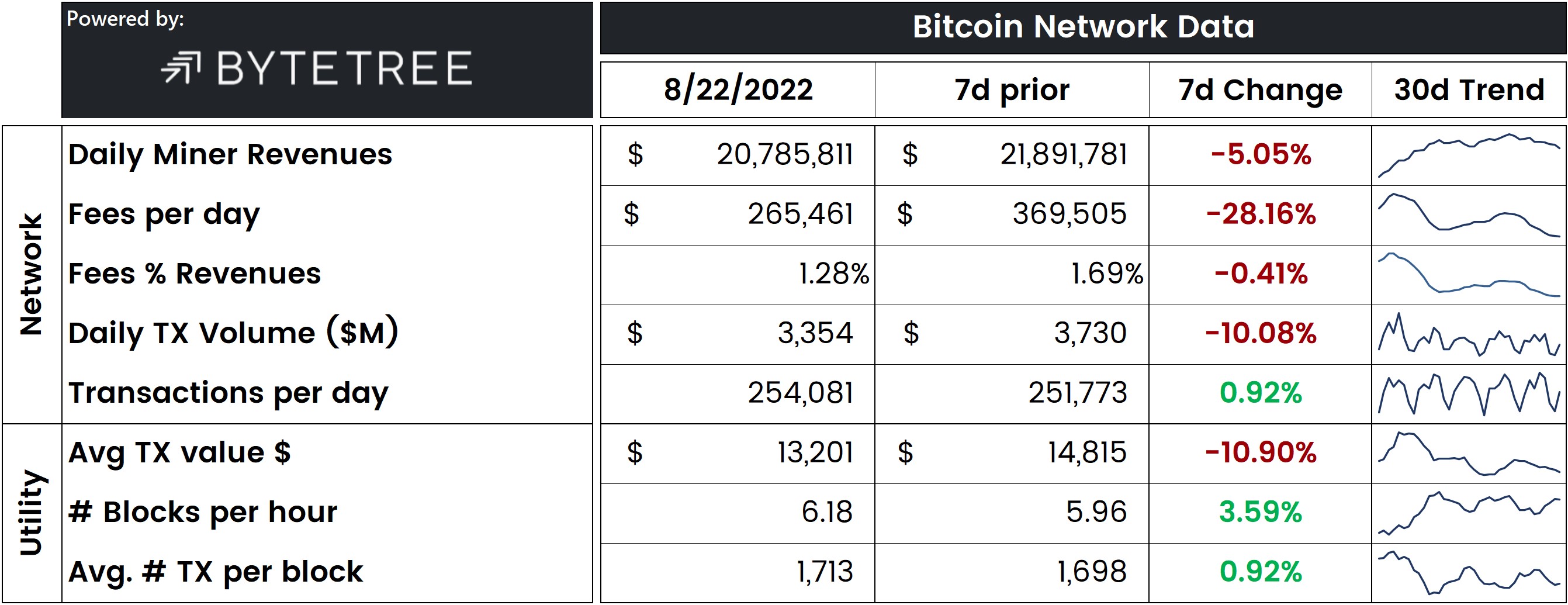

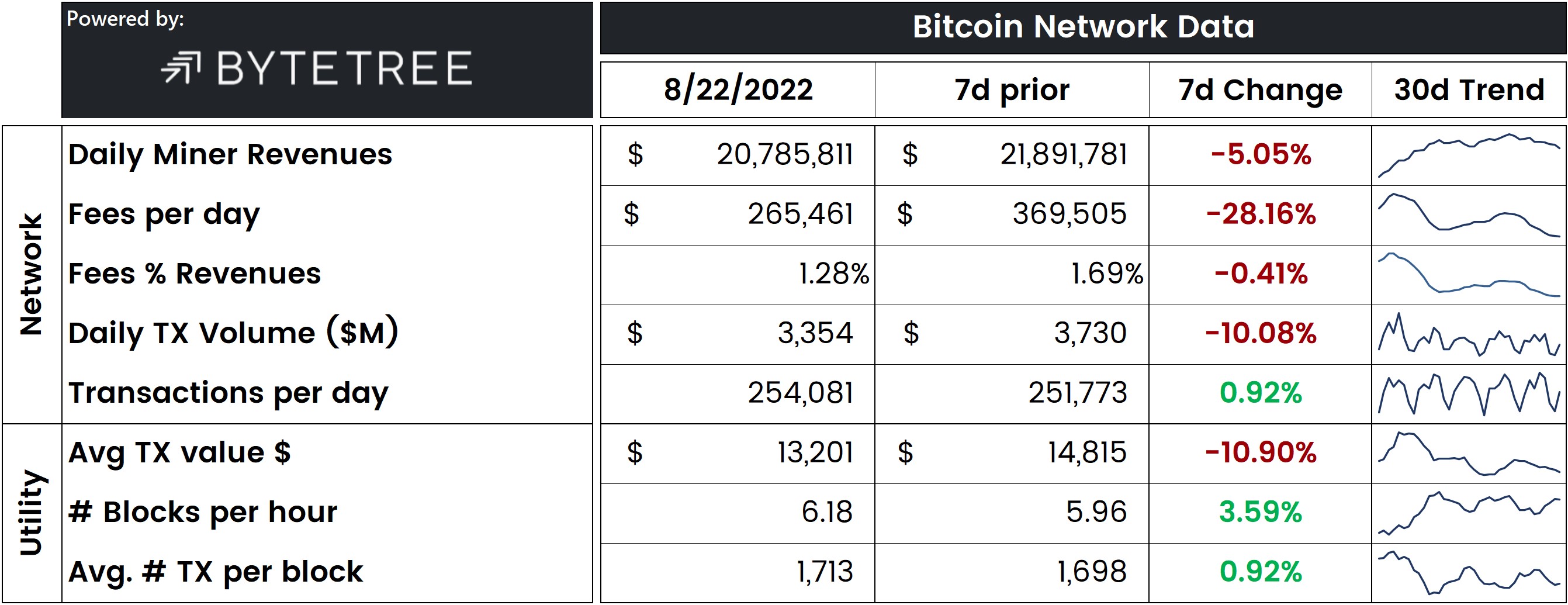

Transaction fees are plummeting to levels not seen in more than two years, and now make up only 1% of miner revenues.The daily transaction fees plummeted by 28% over the past seven days and were only $265,000. It's the lowest level since April 2020 and signals very muted on-chain activity at the moment.Transaction fees now make up only 1.28% of miners' revenues, and miners receive almost 99% of revenues from the block subsidy of 6.25 bitcoin.The transaction fees over the past seven days equal an average of only 0.08 bitcoin per block, substantially below the historical average of 0.4 bitcoin. The block reward consists of the block subsidy plus transaction fees. As the block subsidy decreases due to the halving, the transaction fees will gradually become a more critical source of miner revenue.In the long term, the level of transaction fees will have massive implications for Bitcoin's security and energy consumption. This article estimates Bitcoin's energy consumption in 2040, explaining how vital the fees will become.Why are transaction fees so low currently? First of all, we see a 10% decline in the daily transaction volume, which is now sitting at $3.3 billion, a very low level historically. This is caused by an 11% decline in the average transaction value.Secondly, the block production rate has been at 6.18 blocks per hour, slightly higher than the target of 6. The higher number of blocks has increased the block space supply, at the same time as we see depleted block size demand. These supply and demand dynamics have led transaction fees to plummet.