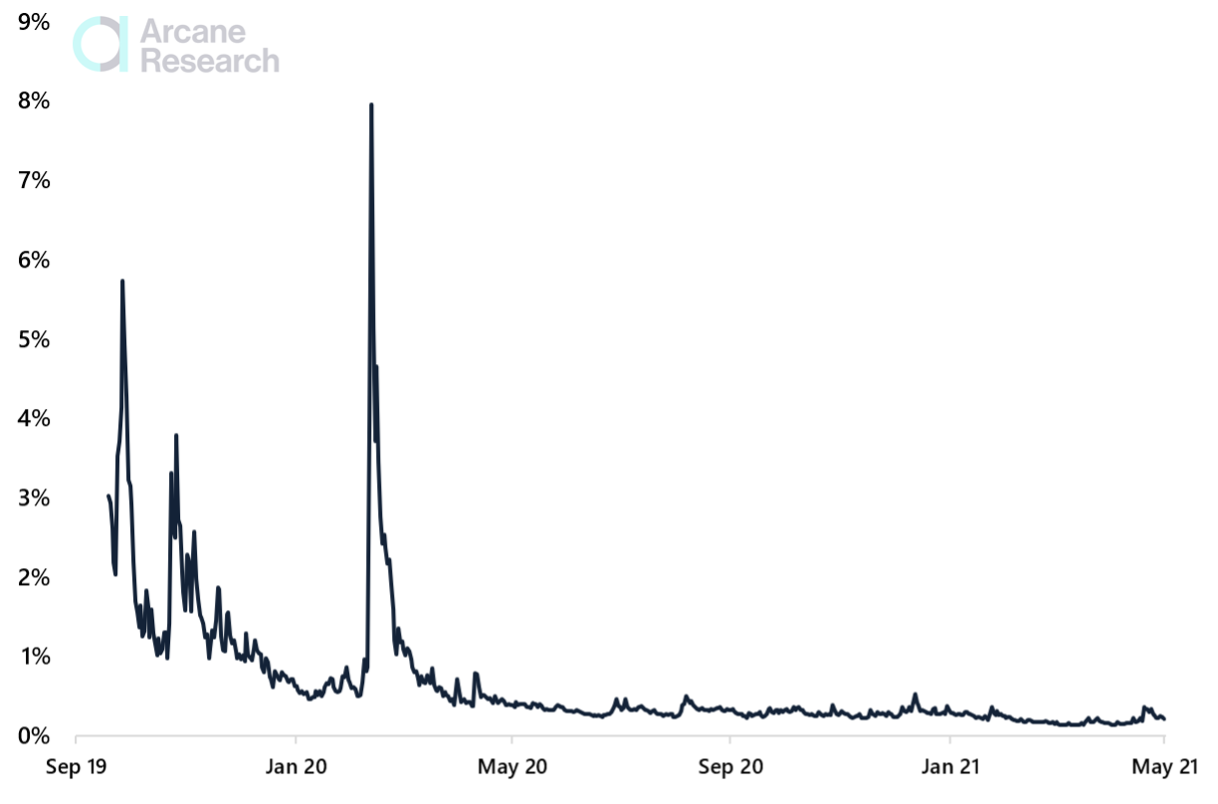

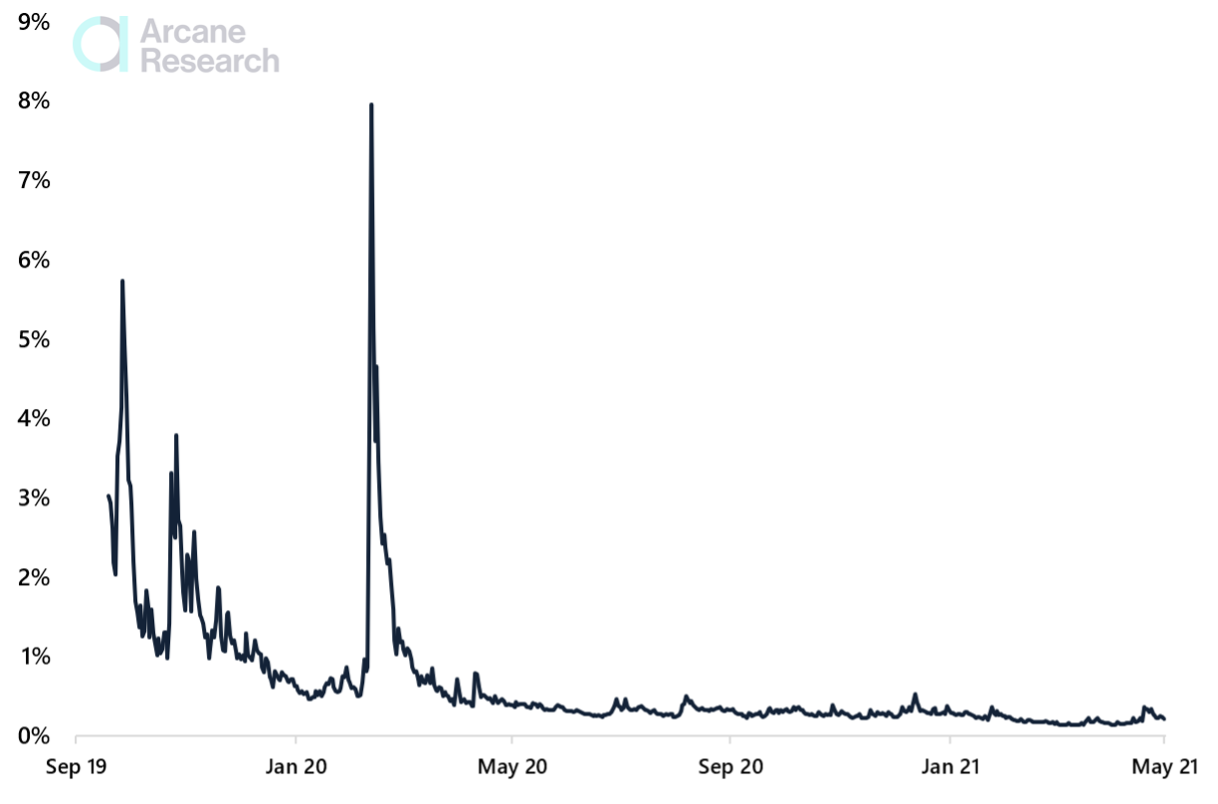

Market makers: The core building block of the bitcoin trading ecosystem

The crypto market is highly fragmented, and a recipe for chaos and arbitrage. Market makers are the watchdogs of this market, creating order where disorder is inevitable by allowing efficient prices across exchanges and other trading venues.They are incentivized and rewarded through spreads, getting paid to fill up order books, and have bundles of capital ready to deploy on the tiniest arbitrage opportunities.This blog post is an extract from our latest report: “The Bitcoin Trading Ecosystem”. In its early days, the market making in crypto was poor and thin order books led to high slippage and poor infrastructure. Close-ended exchanges made it difficult for arbitrageurs to indulge in price dislocations. Since 2016 this has drastically improved. Now, digital assets are priced more efficiently, and the slippage of large block trades has been reduced. Banking infrastructure has created synergies allowing market makers to deploy and move funds efficiently between exchanges, serving an important role in driving the bid/ask spreads closer. The chart below illustrates how the market has improved. The Bid/Offer spread on a $10 million trade on Binance has been reduced drastically, as the overall liquidity in the market has improved.Binance: $10m Bid and Offer Spread (%, Daily Average) Source: SkewThese market makers provide liquidity, reducing the impact of large market orders, which is a fundamentally important part of the crypto markets. They enable liquid trading, reducing the friction costs of transacting, benefiting all of the various entities in the market. Liquidity could lead to fewer flash crashes, benefiting exchanges. For instance, the flash crash in 2017 was extremely expensive for Coinbase, as they compensated those impacted through refunds and ended up paying out millions of dollars. Buyers and sellers see narrower spreads, reducing their cost when committing a trade.Over the last years, some market makers have become cornerstones of the efficiency of the crypto market. They have accrued vast amounts of capital and have positioned themselves into core positions in the ecosystem. They are fundamentally important to the maturing dynamics of the market, and this will likely continue going forward.Download the report below to learn more about the evolving bitcoin trading ecosystem.