Market update: Macro fears are back

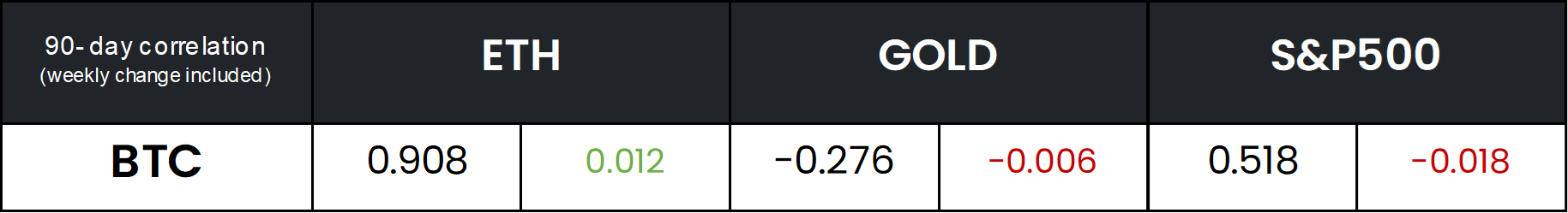

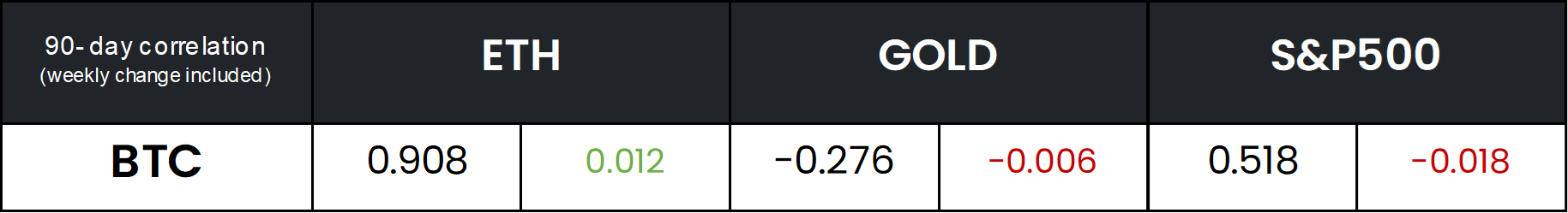

The past seven days have been dreadful for the crypto market as investors prepare for tighter monetary conditions as inflation runs hot. The US Government just released the highest CPI numbers in more than 40 years - 8.5%.Bitcoin is down 14%, ETH is down 14%, while BNB is the best performer of the top 3 with a 9% loss.Bitcoin's correlations with other risk assets continue to stay elevated. Its 90-day correlation with ETH is now 0.91, the highest since June 2020, while its 90-day correlation with the S&P 500 hit an all-time high two weeks ago.One of the predominant negative narratives surrounding bitcoin during the second half of 2021 and the beginning of 2022 was its high correlation with risk assets. During March, investors seemed to have forgotten about this, but now it seems this narrative may come back stronger than ever as the FED desperately tries to tame the not so transitory inflation.The recent correction hit the market broadly, as Monero is the only coin among the top 50 by market cap that is in the green.Source: CoinGecko, messari.io As we approach the middle of April, we see a broad correction in the whole crypto market, with most coins following each other closely on the way down.Source: Bletchleyindexes.com, Bitfinex Bitcoin, the Mid Caps, and the Large Caps are all down 13-14% in April after moving closely in tandem, just like they did in March.The volatile Small Cap Index has started April terribly and is down 25%, in stark contrast to its 40% gain in March.The current poor market conditions have led to considerable increases in the market cap dominances of the stablecoins USDT and USDC, as treaders seek refuge in these coins.Source: Coinmarketcap.com While we saw increasing optimism and prudent risk-taking at the end of March, April started with a risk-off sentiment. Crypto investors are currently migrating from riskier Small Cap assets into large-cap assets and stablecoins.The market continues to take crypto investors on an emotional rollercoaster. For the third time in 2022, the market sentiment shoots up to the "greed" area, only to fall back into fear territory shortly after. Will 2022's repeated disappointments make market participants more cautious in showing optimism?The 7-day average real bitcoin trading volume* sits at $2.8 billion, the lowest level since December 2020. Spot volumes have been trending down for a while but saw a sharp decline during the past seven days. Especially the last weekend saw meager trading activity, with just $1 billion worth of bitcoin changing hands last Saturday. Source: Skew, Tradingview (Binance, Binance US, Bitfinex)

We see a slight increase in bitcoin’s volatility this week. Most of the recent volatility has manifested itself on the downside, as the bitcoin price fell more than 5% on two of the past seven trading days. The volatility uptick comes after a prolonged calm period with little price movements.Source: Tradingview (Coinbase)