- Traders on Bybit and Binance still seem to be the most reckless traders in the crypto markets, as they also were this spring.

- It is worth paying attention to Bybit’s share of the global open interest in the bitcoin futures market. In the weeks running up towards the crash, Bybit’s share of the OI grew from 12% to 16%. A high global share of Bybit’s OI could indicate that it is time to take some chips off the table.

13 Sep 2021

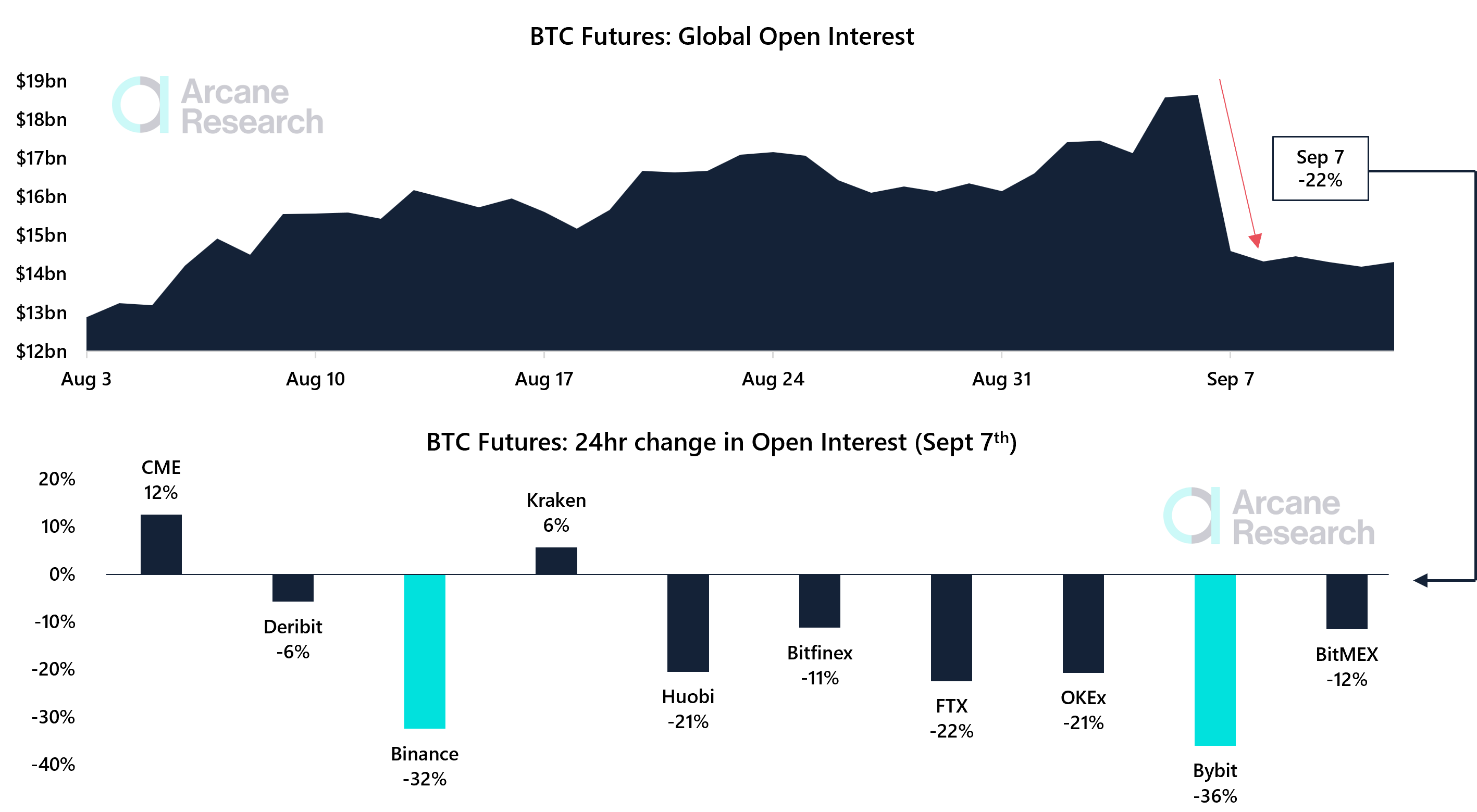

Open interest on Bybit and Binance slammed during the Sept 7 crash

The global open interest in the bitcoin futures market declined by 22% on September 7th, with Binance and Bybit seeing the sharpest fall.

Following the September 7th crash, the open interest in the bitcoin futures market fell by 22%, from $18.6 billion to $14.5 billion.Denominated in BTC the open interest fell from 360,000 BTC to 310,000 following the crash. This was, in other words, a massive deleveraging event, and following the crash, the markets seems more healthy overall.Examining the open interest developments within the various futures exchanges on Sept 7th shows that Binance and Bybit traders took the largest hit during the crash.Bybit’s open interest declined by 36% last Tuesday, while Binance’s open interest fell by 32%, compared to the global average decline of 22%. This illustrates two points: