Opinion: Crypto, MMT, and the Nature of Money

Closing the window on gold opened the door for Modern Monetary Theory, arguing for currency as a government monopoly. Fast forward to 2008, and Bitcoin was created in response to this very concept.Fundamentally different but joint in their controversy, both ideas have re-entered the mainstream conversation as we are approaching the post-pandemic world. At the moment, there is no consensus on either.

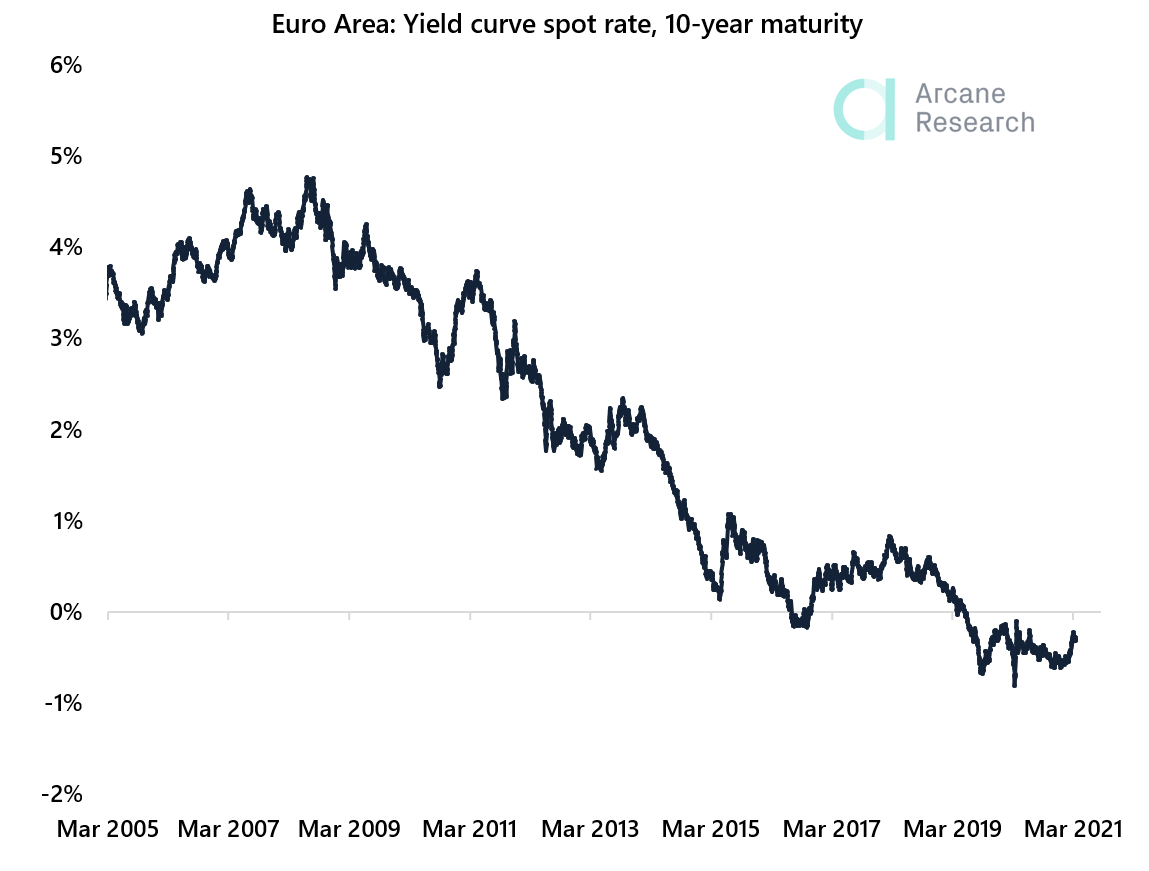

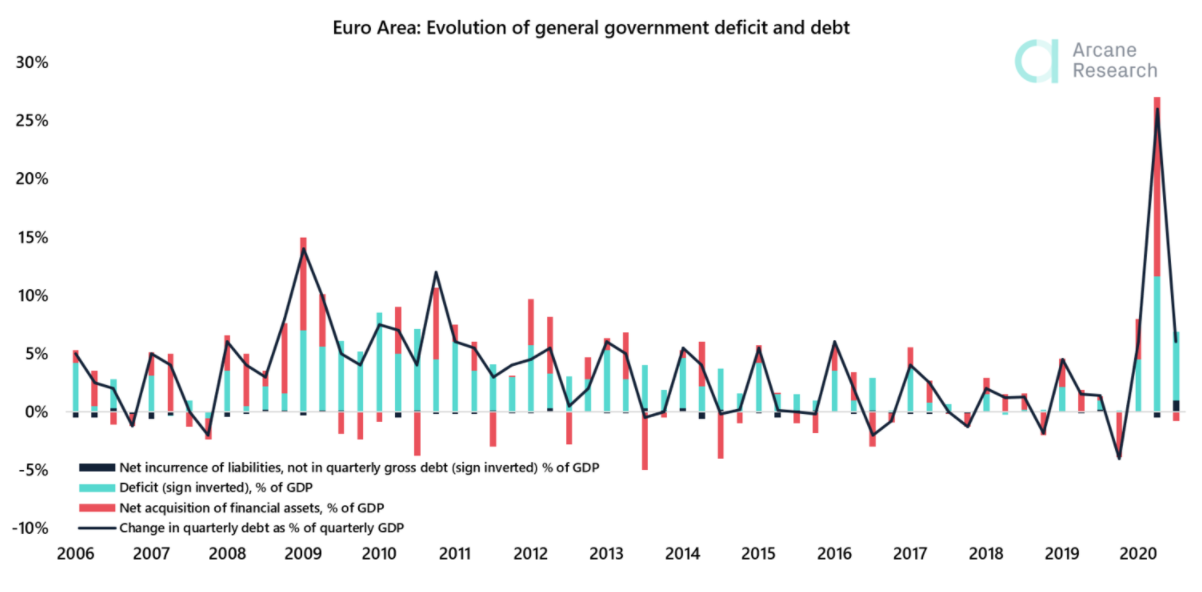

The fiscal response to the Covid-19 pandemic comes with unprecedented costs. The ECB’s balance sheet expansion — up €2.42 trillion since the beginning of 2020 — has been remarkable compared with its roughly €1 trillion response in 2008-2009. Interest rates remain at all-time lows, while debt levels have reached all-time highs.During 2020, the joint budget deficits of European Area governments soared to 11.6% of GDP in Q2, more than four times the 2.5% deficit recorded in Q1, and well surpassing the 7% deficit recorded in Q1 of 2010.Central Bank policies have since been fueling markets everywhere, fostering a widening wealth gap and the notorious “BRRR” memes. While the money printer is running at full speed, here is a breakdown of how MMT relates to crypto prices.Quantitative Easing (QE)

A key principle of monetary policy; to increase the rate of growth in a country, interest rates are cut to encourage consumer spending, thereby increasing the effective demand and ultimately profitability. However, when interest rates are approaching zero, Central Banks are left with the option of injecting money directly into the economy by buying financial securities. This process is known as Quantitative Easing and has the following effects: - Bond prices increase as their demand increases.

- Interest rates are reduced.

- Banks have more money reserved than required, and the money supply in the economy increases.

A result of this stimulus is that when asset prices increase and interest rates are low, risk premiums get twisted. As a rule of thumb, cash is safer than bonds, which is safer than equities, which is safer than alternative investments. However, when bond coupons are at 0%, and the money printer is running on max, equities and digital assets don't look that risky. This ultimately triggers a rally for all assets, most notably in the ones that previously were associated with the greatest risk (consider that Bitcoin and gold correlation reached a record monthly average of 70% in 2020).Simultaneously, as the ECB continues to increase the stimulus, they are widening the wealth gap. Investors take profits and are incentivized to invest more, asset prices go up, and investors are rewarded. Contrary to boosting general consumption, it boosts the inclination to invest. This is essentially how low interest rates enrich Wall-Street while Main-Street falls behind.Although higher asset prices generally mean lower returns, investors still get wealthier while the real economy experiences larger wealth-, opportunity-, and political gaps. Add automation and globalization to the mix, and you have fewer jobs and lower costs, meaning companies have higher margins and ultimately more profits, which then are returned to asset shareholders. This creates an anti-corporate sentiment, driving governments to spend more on the people for the sake of keeping voters content. Thereby the MMT-style policies and addiction to QE. On an individual level, it is difficult to accept lower wages and higher taxes, although the overall economy would benefit from borrowing relative to the growth of the economy. Thus the only politically viable solution is to print more money.Modern Monetary Theory (MMT)

MMT is like QE carte blanche; countries that issue their own currencies cannot default on their sovereign debt because they can always print more money. The central claim of MMT is the lack of financial restraints on non-inflationary government spending below full employment. The so-called expansionary fiscal policy only pays for itself with balanced budget fiscal policy, but budget deficits are irrelevant in MMT, which denies the need to finance deficits with taxes. Instead, taxes are part of the reflux mechanism, which allows the government to drain excess liquidity from the system. In a no-growth economy, that means the money supply would continue to increase, which must be unsustainable.The lurking inflation

Inflation figures in the European Area might not look concerning. A closer look, however, and it’s absurd to think that the CPI bucket remains widely recognized as a good representation of the reality of inflation. Not only does it fail to measure changes in consumer prices, but instead, it tracks consumer spending patterns that change as prices change. It does not even touch the decreasing value of money. What is the one thing that is deadly for bonds? Inflation. And with the potential threat of a sinking bond money portfolio in terms of purchasing power, there has been a new-found interest in cryptocurrencies. In a Fidelity survey of close to 800 institutional investors across Europe and the US, conducted between November 2019 and March 2020, 45% of the European investors surveyed owned cryptocurrencies compared to 27% in the US. It is not far-fetched to suggest a correlation with the extended lapse into negative interest rates across Europe since 2014. To make matters better or worse (depending on your perspective), European banks have lost almost 50% of their value since the introduction of negative interest rates. The European banking system is under pressure, and with each passing year of negative interest rates, that pressure increases, opening for financial alternatives like cryptocurrencies to grow. For the traditional government-loving Europeans, cryptocurrencies are becoming a desirable asset class beyond profit potential but gaining traction in their evasion of political intervention that defines the European Area and the European Central Bank.The not-so-modern monetary theory

In a monetarist view, prices increase because the value of money decreases. This brings us to what money ultimately is: a store of value. If money is to realize its function, people must have confidence in its ability to retain its value over time. This makes fiat a melting ice cube.Now, increasing government deficits drive the government to sell more debt to pay for the stimulus. This is causing interest rates to increase in order for governments to sell that debt in an already leveraged-long economy. However, as increased interest rates would stall the economy, they will instead buy the debt by printing money. In turn, leaving investors with money that is becoming increasingly worthless, ultimately devaluing the currency and threatening it as a store of value. In the modern money paradigm, money is essentially a societal convention dependent on trust in the institutions. Thus a MMT approach is not viable throughout the current government systems in the western world, in a worst-case scenario inviting the kinds of economic troubles suffered by Venezuela and Zimbabwe. Contrary to emerging markets, reserve currencies like the euro do have the ability to print instead of increasing interest rates. However, each time they do interest rates are pushed closer to zero, thereby limiting the effectiveness of the central bank in further stimulating the economy. Although the Euro Area remains a relatively stable economy, when there is boundless money printing, investors will avoid holding debt tied in a depreciating currency. If the public believes their government is becoming spendthrift, inflation expectations will become rooted in preventive price-rises, resulting in a self-fulfilling prophecy. Enter Bitcoin

Bitcoin and its genesis block were the preface to a digital alternative to traditional central banks and government spending, and has since programmatically reformed money as we know it: instead of governments inflating the supply of money, Bitcoin has introduced an alternative known as a distributed ledger, otherwise known as a blockchain, granting universal access and a predictable and programmable inflation schedule.In cases of hyperinflation like Venezuela and Zimbabwe, Bitcoin could theoretically become an economic escape-hatch allowing individuals to hedge from a local economic meltdown. Although we’re not quite at mainstream application, the non-sovereign money use-case already allows people to reject their local monetary systems. The idea of bitcoinization is not entirely unfounded given that similar dynamics took place with the dollarization in Zimbabwe in an attempt to beat off high inflation through the adoption of a foreign currency.For now, Bitcoin upholds the ‘digital gold’ narrative — a store of value that is easily exchanged and practically impossible to counterfeit. Given its fixed supply, it is deflationary in nature. And before the MMT-fans come at me: deflation is not a decrease in prices itself, but a monetary phenomenon that can cause decreasing prices, meaning Bitcoin is not truly deflationary in the sense that Bitcoin’s supply will not decrease but continue to increase until the block rewards run out approaching the year 2140, when Bitcoin will reach a hard cap of 21 million coins. MMT, on the other hand promotes the printing press as a cure-all and rejects budget deficits and currency demand. Modern, was it?So where does it leave us?

Imagine doing the same thing over and over again, to hardly any relief. Enter quantitative-easing hell.Ideally, we would slowly stop quantitative easing and quickly contrive a production level to meet economic growth. If it was only that easy. The ongoing rally in the stock markets can largely be attributed to the growing expectations of economic recovery, suggesting that stock markets more than ever depend on the ECB’s every move. If there are any signs of economic weakness by spring, the ECB will find a way to maintain the bond buying.In economic uncertainty, investors will seek risk-adjusted returns in places with high-quality macroeconomics. As the size and volatility of international capital flows have increased over the past decade, European countries could respond by opting for capital restrictions similar to those already prevalent in BRICS. However, the empirical evidence of the effectiveness of capital controls in meeting domestic policy objectives is mixed.The case for cryptocurrencies

There are a number of narratives justifying a bullish move higher for crypto; the two main long-term justifications being (i) as a potential store-of-value and (ii) as a currency. Bitcoin as a store of value is a concept prone to criticism due to its short-term volatile nature. However, for those who consider hedging potential inflation risk with a limited-supply asset that can be easily exchanged for fiat, the idea of Bitcoin as a ‘digital gold’ is very relevant. One could even claim that Bitcoin is far more valuable than gold, considering its increased utility in terms of buying, transferring, and storing it. Analogous to Pascal’s wager; the risks of not believing in God are far greater than the ‘costs’ of believing in God; substantial potential payoff vs. fairly little cost. Even a small allocation can have a significant impact on portfolio performance.Cryptocurrency as a recognized currency might be harder to imagine, but even Facebook argued that the traditional bureaucratic banking system is outdated before they were shut down by custodians feeling the threat of an open capital market. That is not to encourage spending your Bitcoins on pizza; the concept of crypto as a currency is more congruent with Ethereum – an emerging non-sovereign digital money with a growing decentralized economy that continues to attract both human and financial capital. Comparing the value of Bitcoin and Ethereum would be unreasonable, as commodities cannot be judged on criteria they weren’t designed for. But together, they are embodying Metcalfe’s law.When we understand that the world is structured by belief, we understand that value can be an illusion. Money is an abstract concept. Its value requires us to believe in it, which is why banks use ancestral heroes to make money seem almost holy. Crypto is as much of an idea as all other money; its value lies merely in belief. But instead of banks and central authorities, it is pure code. Transparent in its mechanism but private in its use, Central bank currencies are the exact opposite; their management is obscured, but our use is surveilled.Going forward

Navigating the current market, the crucial question is whether inflation will remain subdued. Or will the boundless increase in QE-financed government spending cause inflation to blast off, as the easing on lockdowns releases curbed demand? For better or worse, and regardless of whether the measures are justified by the ongoing pandemic crisis, Europe and the Western world is heading for the largest-ever increase in Central Banks’ balance sheets coupled with a crackdown on civil liberties. Cryptos, while at an early stage of their lifecycle, has been the most exciting and promising currency development since the introduction of fiat. It is not if, but when. So stop trying to determine your entry point, you never will. Put an end to the intense feelings of FOMO, and take comfort in knowing that Arcane Research is an email away if you need any help navigating the space.Thanks to Vetle Lunde for the input on this piece.