03 Jan 2022

Starting the new year fresh: Options market reset

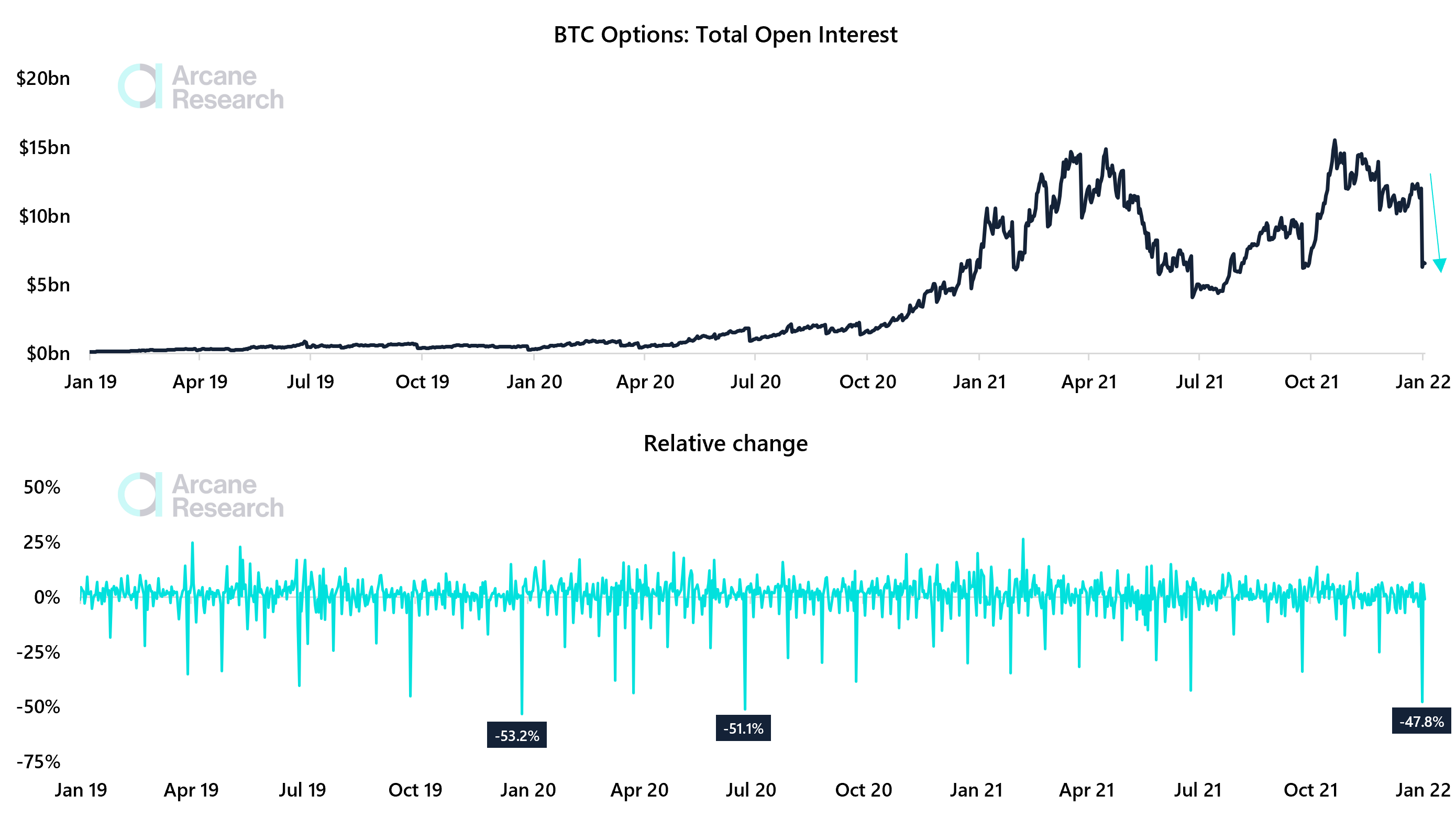

The December options expiry saw the third-largest relative decline in open interest in the BTC options market history as 47.8% of OI expired.

The December 31st options expiry saw $5.8bn worth of open interest expiring, equaling 47.8% of the open interest in the market the day prior.This is the third-highest relative options expiry in bitcoin, only beaten by the June 2020 expiry and December 2019.The open interest in the December contract had been building throughout 2021, with large open interest accumulating in far out of the money bullish strikes expiring worthless.Interestingly, the December 31st options expired close to the yearly volume-weighted average price of $47,600. Prior monthly expires also tended to settle close to the monthly VWAP.The options market could potentially contribute to anchoring the BTC price. In January, February, March, April, October, and November, bitcoin saw strong returns in the first half of the expiry period and negative returns in the second period.This could be circumstantial, but it could also be caused by the market structure with options expiries as well as futures expiry. Nevertheless, it is interesting to note this market behavior over the last year.