Why are BCH and BSV ahead of bitcoin?

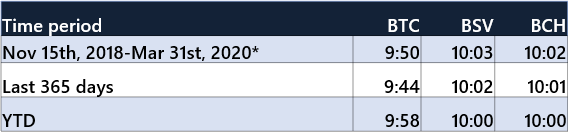

The bitcoin cash fork of August 2017 included the implementation of a difficulty adjustment algorithm with more adaptive and frequent difficulty adjustments than bitcoin’s difficulty algorithm. This was necessary in order to avoid slow block discovery due to a lower hash rate. However, this algorithm was gamed in the initial months by miners varying their hash rate day by day. This led to some days featuring as little as one generated block per hour, and other days featuring as much as one block generated per minute. This allowed miners to inflate the BCH supply much faster than what was intended in bitcoin, by accelerating the generation of new blocks. This acceleration is the reason behind the early halving of BCH and BSV.In November of 2017, a hard fork was implemented on BCH to solve the difficulty adjustment issues. After this hard fork, the day by day block count has been much more reliable and stable. As shown in the table below, bitcoin has actually had a faster block generation and inflation rate than both BCH and BSV after the fix. Over the last year, bitcoin has had an average time of 9 minutes and 44 seconds between each block, significantly lower than the target of 10 minutes per block. This is the result of growing hash-rate in bitcoin. With difficulty adjustments happening only every 2 weeks (actually every 2016 block), the increase in difficulty has been lagging the growth rate. BCH and BSV on the other hand, with a faster block adjustment based on a moving average of the latest 144 blocks, has had a block production rate much closer to the target of one block every ten minute.

Preview

The expected effects from the BCH and BSV halvings

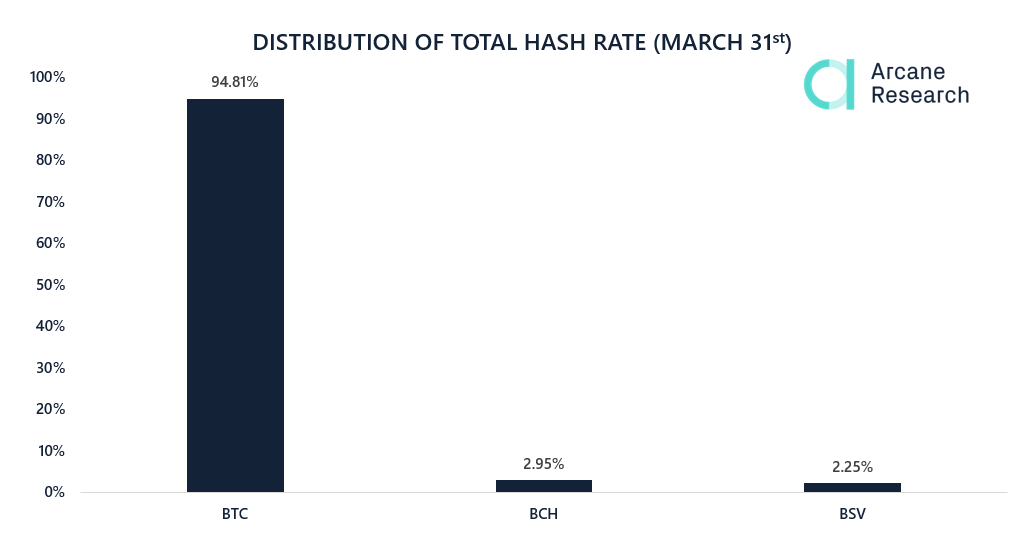

As the mining reward is halved on Bitcoin Cash and Bitcoin SV we expect some miners to switch over to mining bitcoin. This will happen as the profitability of mining bitcoin will be higher, compared to mining BCH or BSV, all else equal. Mining is a competitive market. The marginal return on mining bitcoin, BCH and BSV should therefore be equal prior to the halving. When rewards are cut in half for BCH and BSV, the profitability of mining those coins are also cut in half, forcing a shift in the market.In order for BCH or BSV mining to stay profitable, the difficulty also have to be halved to counter the reduced reward compared to bitcoin. There will also be an effect of bitcoin difficulty adjusting upwards as more miners start mining BTC. This effect, however, will be small because:- The hash rate devoted to BCH and BSV is very limited compared to bitcoin

- The difficulty algorithm of bitcoin will take two weeks to adjust

Bitcoin dominates sha256-mining

Preview

- The Bitcoin Cash halving is estimated to happen on the 8th of April, around 17:00 CET

- The Bitcoin SV halving is estimated to happen on the 10th of April, around 18:00 CET

- The Bitcoin halving is estimated to happen on the 13th of May, around 20:30 CET