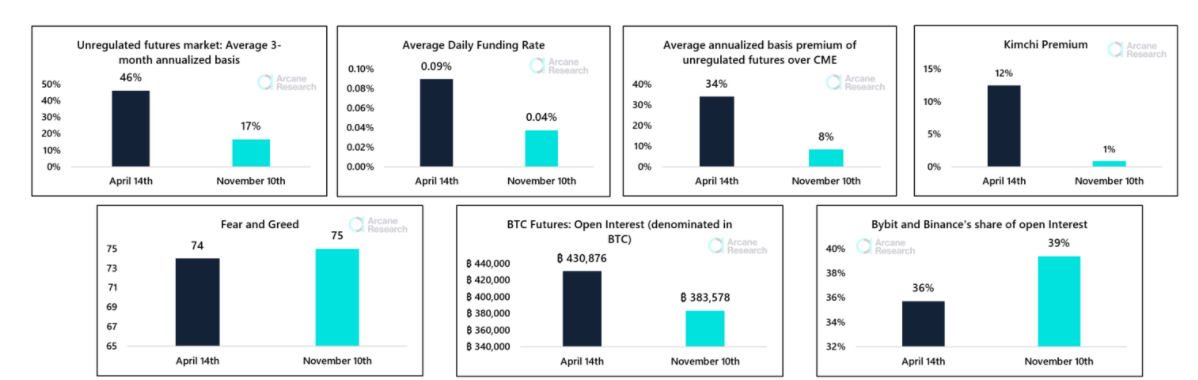

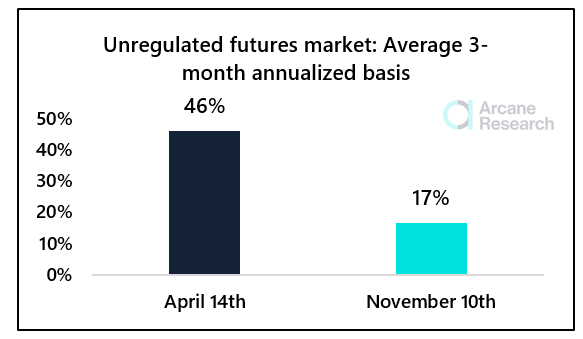

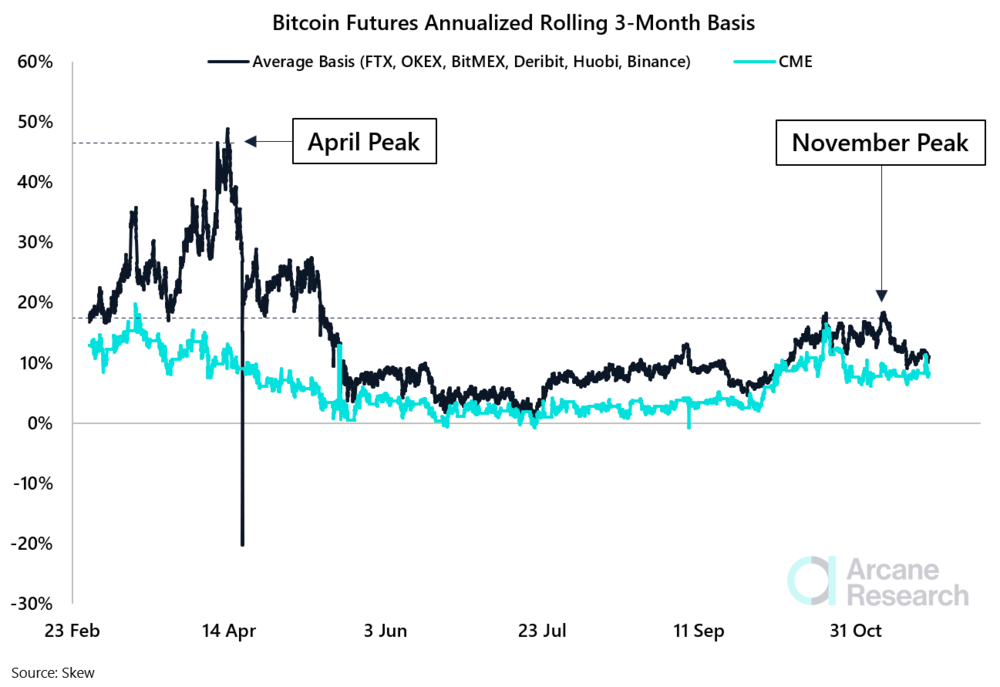

The 3-month annualized basis

Preview

Preview

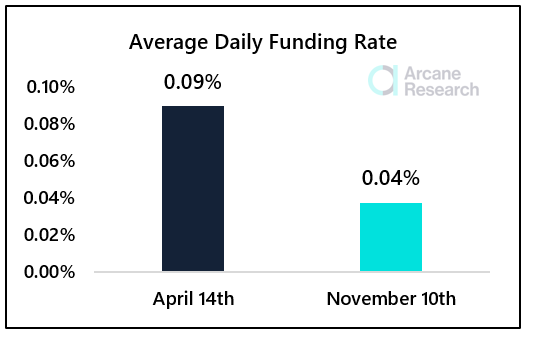

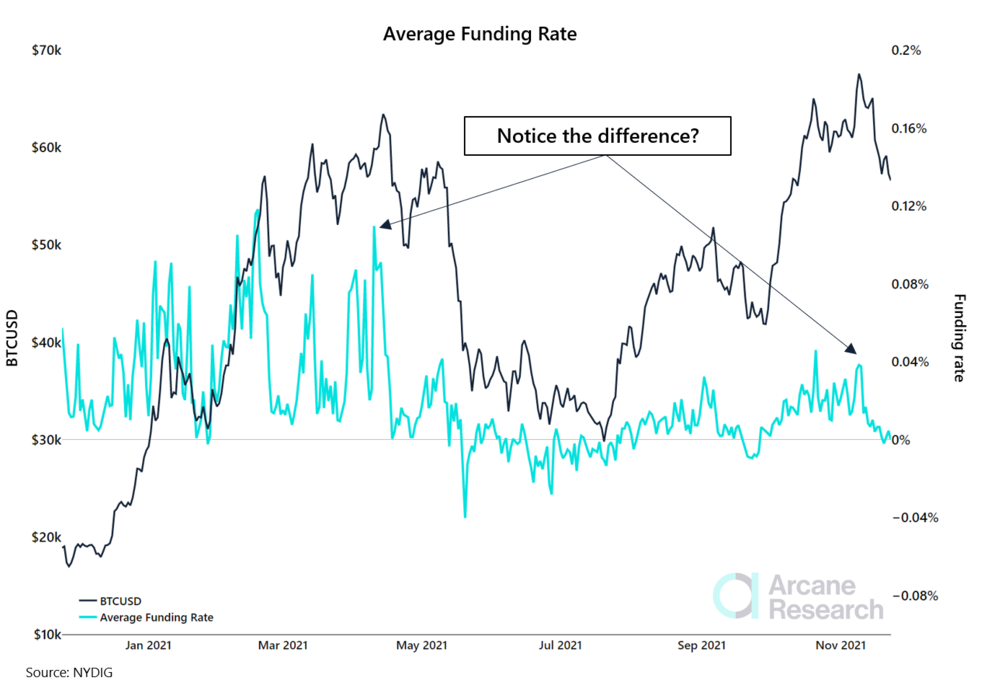

Funding rate

Preview

Preview

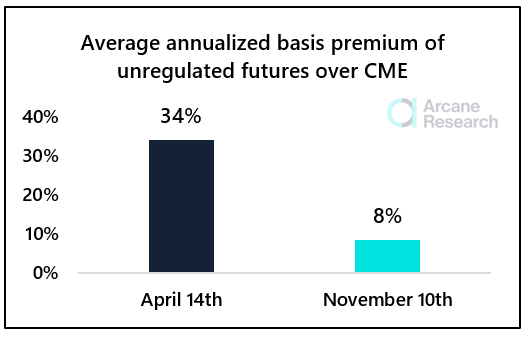

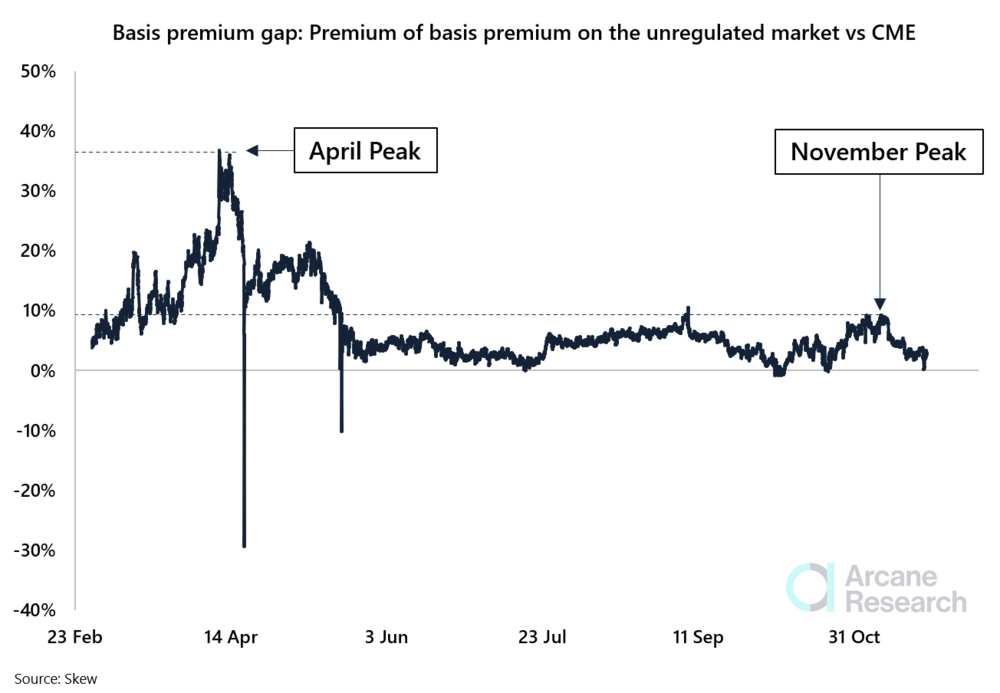

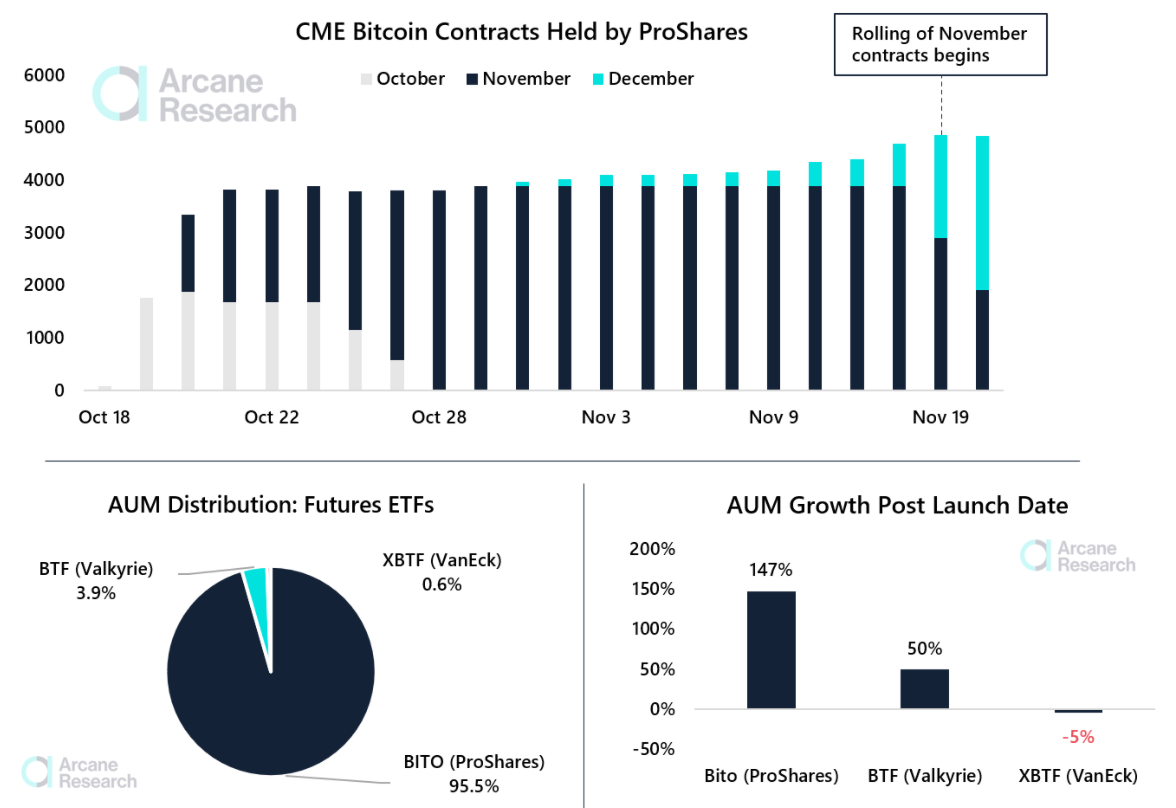

The unregulated offshore futures exchanges vs CME: The basis gap

Preview

Preview

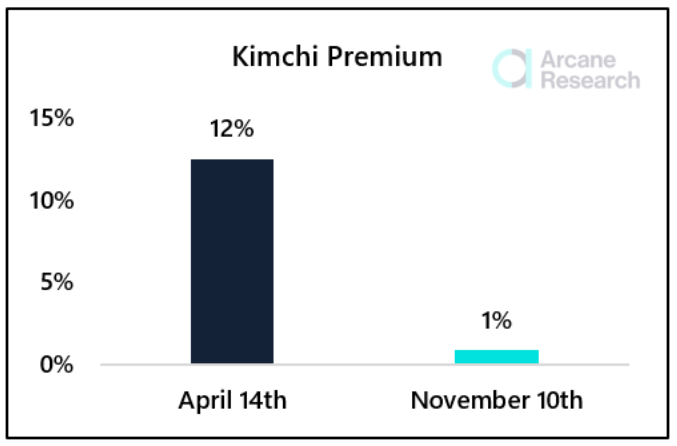

The Kimchi premium

Preview

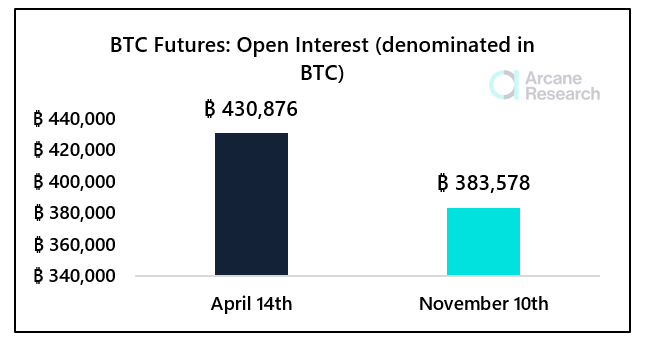

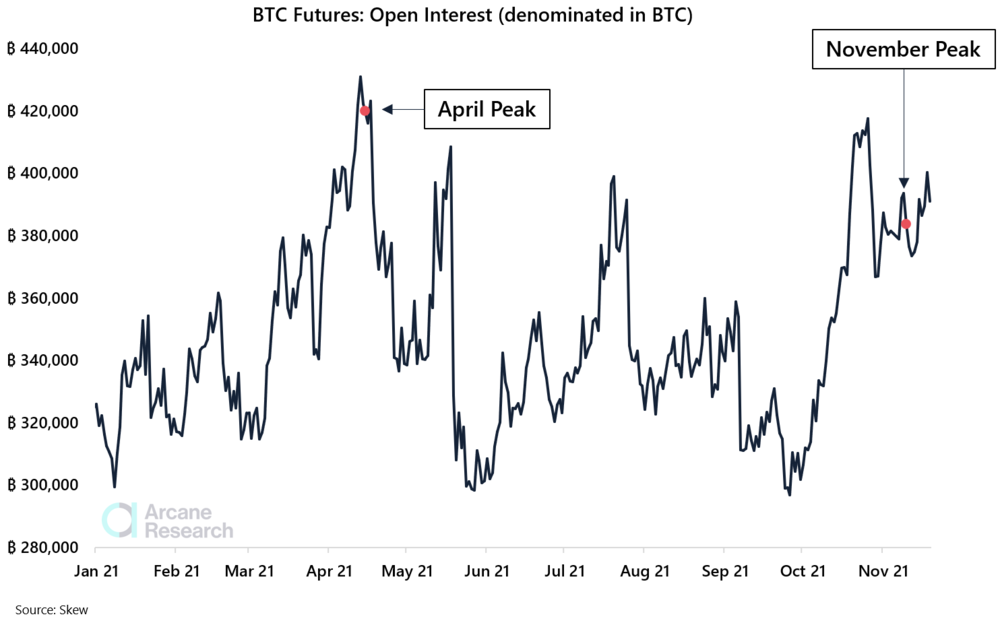

Open interest, denominated in BTC.

We prefer denominating the open interest (OI) in BTC. OI measured in BTC makes it easier to interpret the leverage in the market relative to the circulating supply. Thus, we view this indicator as a nice way to gauge the leverage in the market.

Preview

Preview

Preview

Open interest: A not so pleasant November truth

Preview

Preview

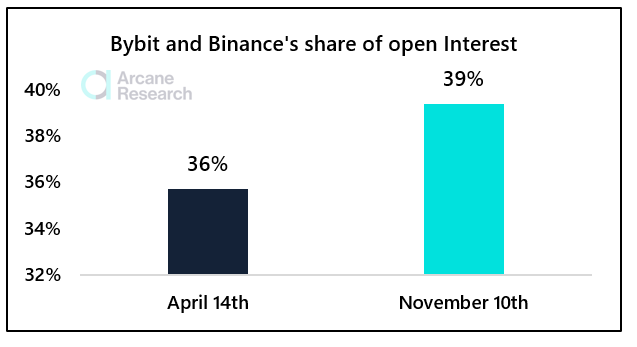

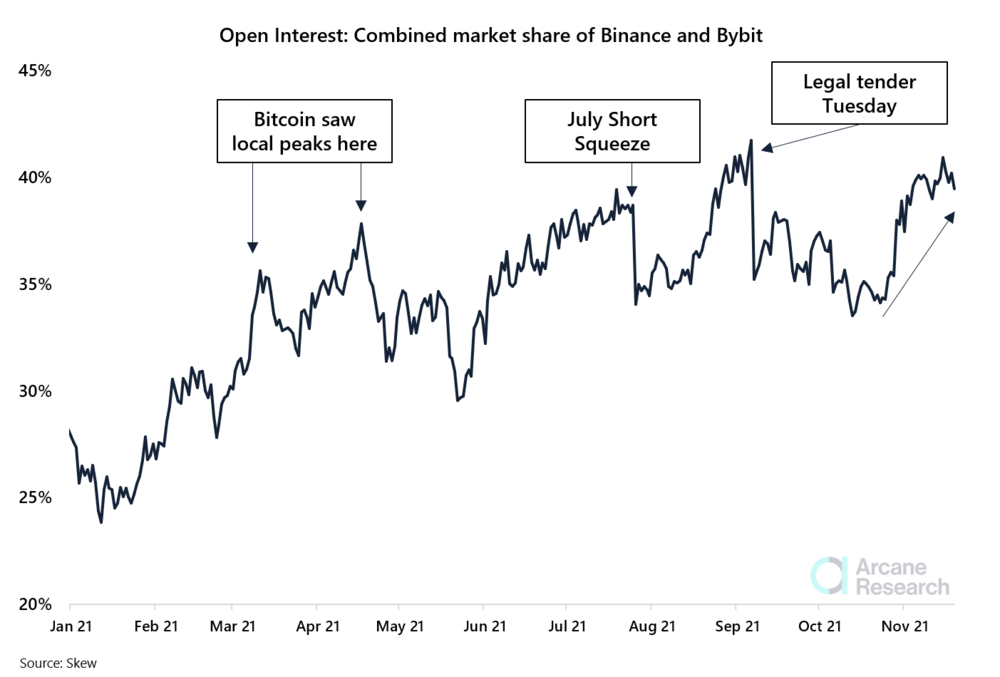

- On Feb 23rd, $3.6bn worth of liquidations occurred in the crypto futures market, of which $1.6 billion originated from Binance, meaning that 44% of all liquidations in the BTC futures market originated from Binance. Similar numbers were seen during other infamous long liqs in bitcoin this spring. On Feb 23rd, Binance accounted for 17% of the OI in the BTC futures market.

- During the Sept 7th crash in Bitcoin, $3.13 bn worth of liquidation occurred in the crypto futures market, of which $1.19bn originated from Bybit, meaning that 38% of all long liquidations originated from Bybit. At the time, Bybit accounted for 16% of the OI in the BTC futures market. (Ps: Binance had already restricted their liquidation data at this point in time).

- On November 15th, Coinglass reports a long liquidation volume of $254m in BTC longs.

- On Nov 15th, Bybit accounted for 16% of the OI in the BTC futures market. Assuming the same relationship from Sept 7th holds, $96 million worth of longs got liquidated on Bybit during this round of liquidation, increasing the real liquidation volumes to $350 million in the BTC futures market.

- Binance, on the other hand, had increased its market share to 25% of the OI in the BTC futures market (From 17% on Feb 23rd). Assuming naïvely that the relationships mentioned above remain, I make the following back-of-the-envelope calculations of the Binance long liqs on Nov 15th:$350m * (1+0.44) * (25%/17%) -$350m = $391m.

- This sums up to a total long liquidation volume of $742m on November 15th, quite a lot higher than $254m, eh?