Trading and choice of execution venues

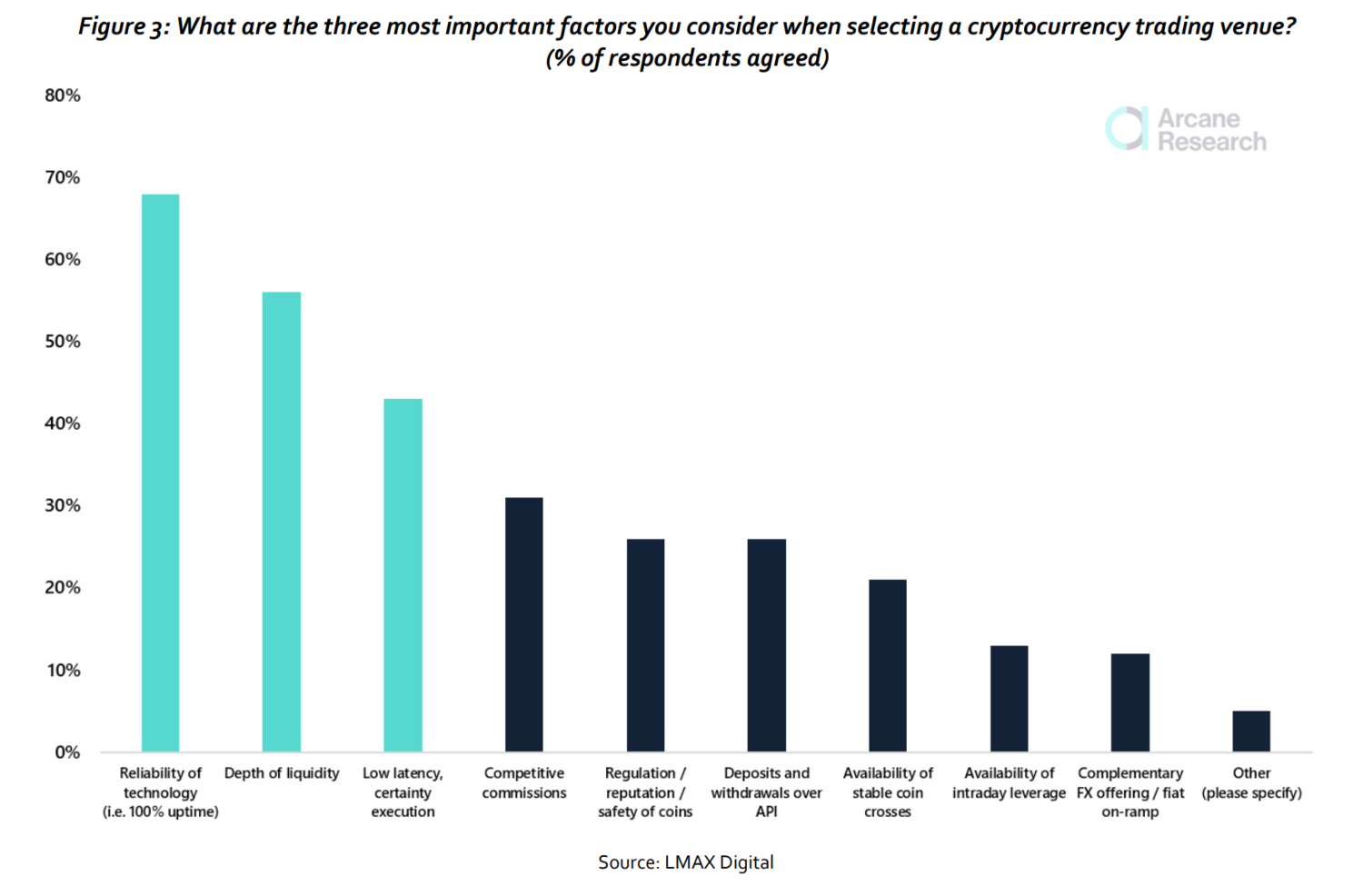

The institutional market participants were asked about the most important factors that they consider when selecting a cryptocurrency trading venue. As seen from the chart above, three factors stood out: 1) Reliability of technology (i.e., 100% uptime), 2) low latency and certainty of execution, and 3) depth of liquidity.

Preview

Custody

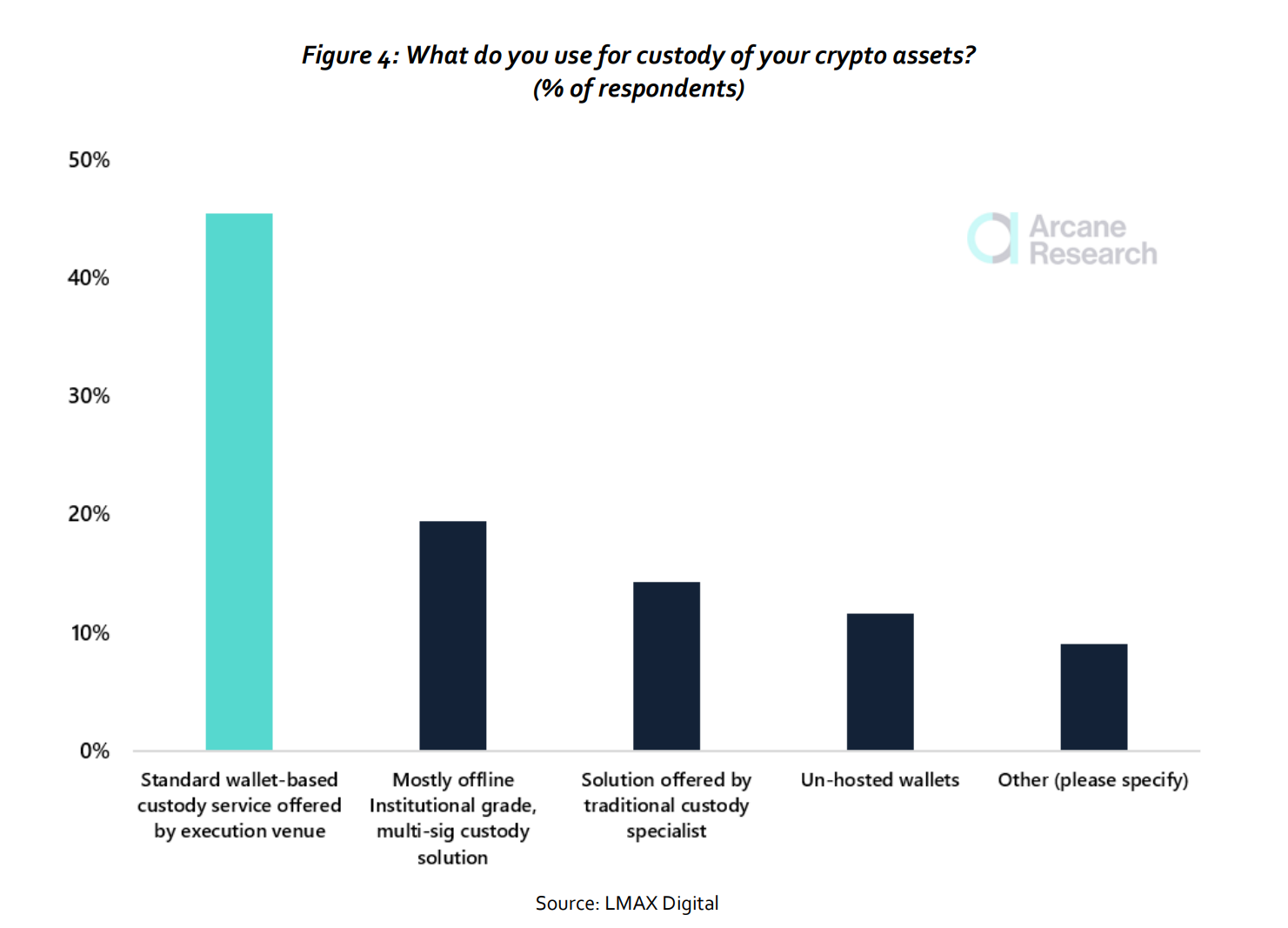

When asked about the choice of custody solutions, most of the respondents said they use standard wallet-based custody services offered by the trading venue itself. Interestingly, a significant share of the respondents said that they use solutions provided by traditional custody specialists. The results are presented in the chart below. In another custody question in the survey, security was unsurprisingly highlighted as the most critical factor when selecting a custody offering. In addition, accessibility and convenience, together with exchange/liquidity connectivity, were also highlighted.

Preview

Infrastructure gaps

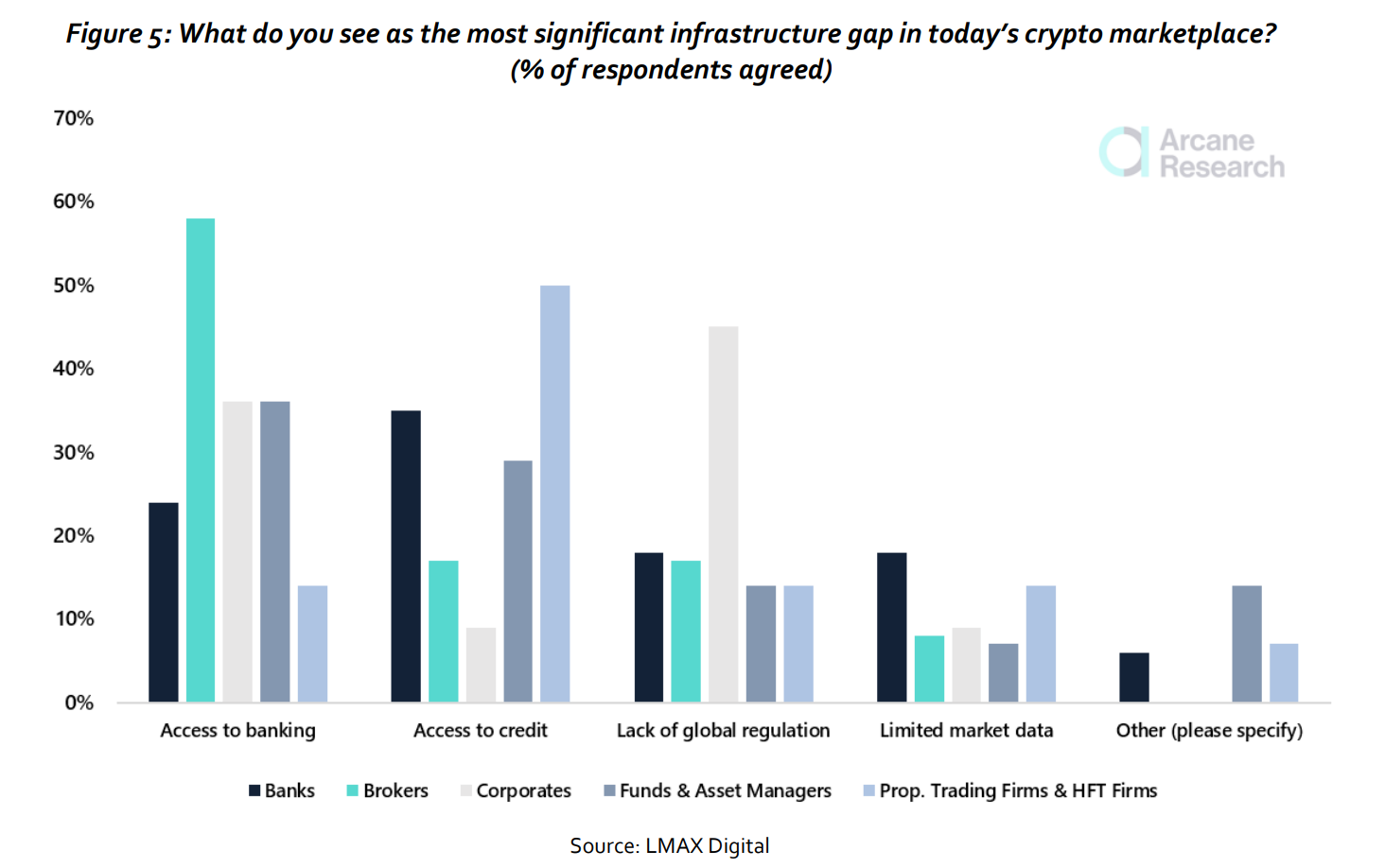

As already mentioned, the infrastructure has improved, and it is now easier for institutional investors to hold and invest in bitcoin. But what are the most significant infrastructure gaps in today’s bitcoin market, according to the institutional market participants? As seen from the chart below, access to banking and access to credit are the two main issues today. Access to banking has been particularly highlighted by brokers, while proprietary trading firms and HFT firms see access to credit as a big gap. Notably, corporates see a lack of global regulation as a major concern.

Preview

Institutions to dominate bitcoin trading?

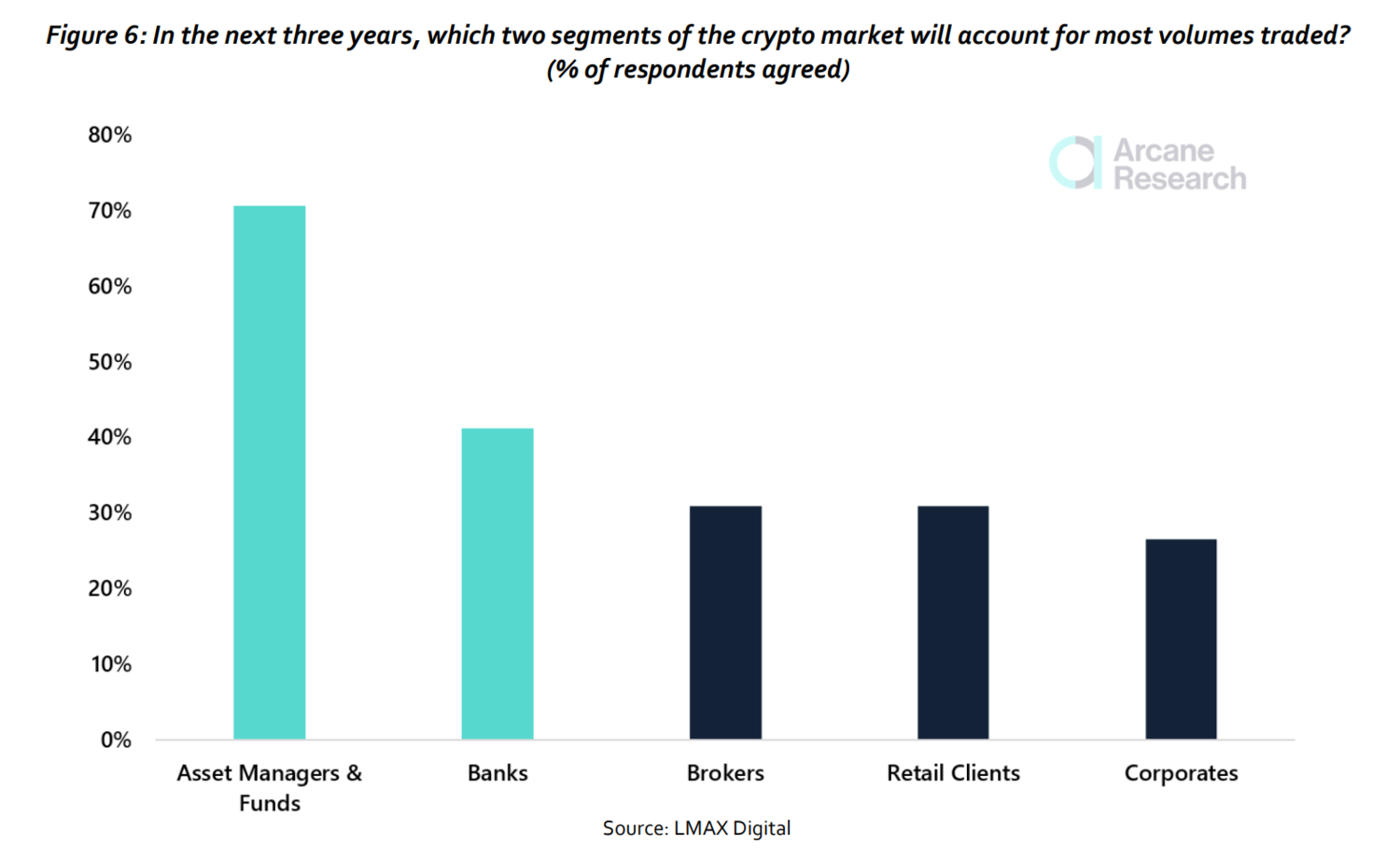

Institutions are fully embracing the cryptocurrency space, and as seen in the previous section, bitcoin trading volumes have grown substantially among institutional investors since the beginning of 2020. This trend will not stop here, according to the respondents of the survey. As seen from the chart below, they expect asset managers, funds, and banks to be the most significant contributors to trading volume in the next three years.

Preview